We're hiring tax experts: Join our virtual recruitment event to learn more about our remote job opportunities. Register here

Welcome to our community!

You now have exclusive access to job info, training, webinars, employee stories, and more as a member of our Intuit Talent Community for Tax and Bookkeeping.

Featured Video

Intuit & OpenAI: Partnering to Revolutionize the Profession

The partnership between Intuit and OpenAI is integrating generative AI into professional tools to transform complex data into actionable insights. This collaboration empowers experts to deliver faster, more accurate financial outcomes for their clients with enhanced efficiency.

Intuit in the News

Intuit Expands Nationwide with 600+ New Expert Office Locations

From our new SoHo flagship to hundreds of local offices across the country, TurboTax is expanding its physical presence. Discover how we are combining advanced agentic AI with a network of local human expertise to automate the tedium and focus on what matters most: expert guidance.

What's it like working at Intuit?

Intuit brings TurboTax, QuickBooks, Credit Karma, and Mailchimp to market, trusted products used by approximately 100 million customers globally. We strive to create a workplace environment — onsite and remote — that gives employees the freedom to do the best work of their lives.

Watch this short video to learn why tax experts and bookkeepers come back to work at Intuit year after year.

A Top-Rated Employer for Tax Experts and Bookkeepers

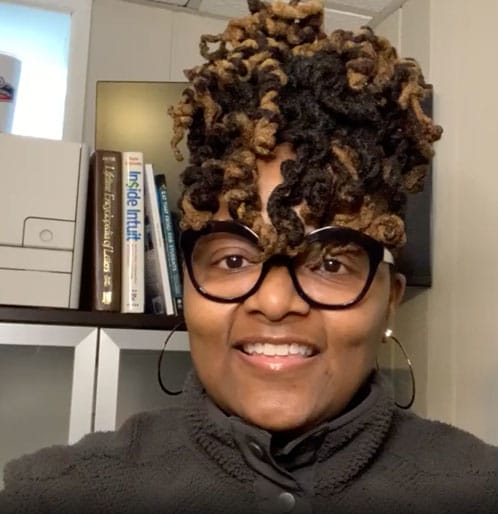

Meet our tax experts and bookkeepers

The flexibility with the work hours and the support you're provided with is unparalleled. Whether you have another full-time or part-time job, a full-time tax practice like I do, or trying to manage other life responsibilities and family commitments, you can mold your schedule into something that fits your lifestyle.

As someone with a full time job, it was very important to me to be able to select my hours for my working schedule as this was a 2nd part time job. Intuit offered me that freedom.

Right after I got through training, my sister was diagnosed with breast cancer... My team supported me and I was able to take her to each and every one of her treatments... and see her through to being breast cancer free. I am so grateful to Intuit because not only did my manager rally to support me but my peers did too. Intuit cares!

View other stories from Intuit

For Tax Experts

Job Requirements

Intuit hires tax professionals across all continental 50 states. Current qualifications for our remote indivdual and business tax roles include:

Tax Specialist: Complete and pass the Intuit Academy Level 1 badge and Intuit Tax Practice Program and possess an active Preparer Tax Identification Number (PTIN).

Tax Associate: Minimum 2+ seasons paid tax experience and minimum 30+ tax returns prepared per season

Credentialed Tax Expert: Minimum 2+ seasons paid tax experience and minimum 30+ tax returns prepared per season and active credential as CPA, EA or Practicing Attorney

Business Tax Associate: Minimum 3 or more years of experience preparing federal and state business tax returns (1065 and/or 1120-S) for at least 20 clients/customers per season for compensation.

Business Tax Credentialed Expert: Minimum 3 or more years of experience preparing federal and state business tax returns (1065 and/or 1120-S) for at least 20 clients/customers per season for compensation. Must possess an active, unrestricted credential: EA, CPA, or Practicing Attorney with strong business tax preparation experience and extensive knowledge of tax laws.

Don't have the tax experience? We've got you covered. Check out the "training tab" to find out how you can get the training you need via Intuit Academy. It will replace the required experience needed.

Bookmark this page to find out about upcoming remote job opportunities with TurboTax Live.

Job Requirements

Intuit hires tax professionals who want to be more than just experts; we look for trusted partners for our communities. These roles are for relationship-driven pros with an entrepreneurial spirit who want to empower clients through a mix of in-person and virtual support. Current qualifications for local tax roles include:

Tax Associate - Local: Requires a minimum of 2 seasons of paid Tax Preparation experience, with at least 30 tax returns prepared per tax year. Candidates should have an interest in building a local and online social presence to provide accessible resources for their community.

Tax Expert - Local: Requires a minimum of 2 seasons of paid Tax Preparation experience (30+ returns per year) and an active, unrestricted credential as an EA, CPA, or Practicing Attorney. Experts must have extensive knowledge of tax laws and experience in holistic tax advisory services.

Don't have the tax experience? We've got you covered. Check out the "Training" tab to find out how you can get the foundational knowledge you need via Intuit Academy. Successful completion of the Academy can help you qualify for Associate-level opportunities.

Bookmark this page to find out about upcoming local job opportunities with TurboTax.

Resources for tax experts

Intuit Tax Preparer FAQs: Salary, Benefits, and More

Thinking about a tax preparer job with Intuit? We’re pulling back the curtain on what it’s really like to work on our team by answering the top 10 questions we hear from candidates.

Best Classes for Tax Preparers

Learn more about free income tax courses and certification programs for job seekers. Also, get the scoop on tax preparer job requirements at Intuit to see if you have the right qualifications.

Enrolled Agent vs. CPA: Understanding the Differences

An in-depth comparison of the CPA vs. EA designations. Discover the professional roles, core differences, and certification requirements necessary to pursue a career as an Enrolled Agent or Certified Public Accountant.

For Bookkeepers

Bookkeeping jobs at Intuit

Intuit hires bookkeeping experts with a minimum of 1 year of QuickBooks Online experience. Current qualifications include all of the following:

- Active QuickBooks Online ProAdvisor Certification

- 1-3+ years managing the books for a small business

- 1+ year experience working with QuickBooks Online

- One of the following (preferred): Bachelor’s degree in Accounting/Finance; Active CPA or CPB credential

- Must reside in the United States

Don't have the bookkeeping experience? We've got you covered. Check out the "training" tab to find out how you can get the training and certification with the Intuit Bookkeeping Certification. It will replace the experience required to work at Intuit.

Bookmark this page to find out about upcoming job opportunities with QuickBooks Live.

Resources for bookkeepers

Bookkeeping vs. Accounting: Here's How They Differ

Ready to explore the world of bookkeeping and accounting? Intuit’s guide is here to help you understand the key differences and show you the career opportunities and benefits in both fields.

How to Write a Bookkeeper Resume: Examples and Tips

Craft the perfect bookkeeper resume using Intuit’s expert tips and a sample template. Highlight your skills and achievements to stand out in a competitive job market and unlock exciting remote opportunities with Intuit.

The Ultimate Guide to CPA Jobs: Everything You Need to Know

Dive into the world of CPA jobs with Intuit’s detailed guide, which covers everything from qualifying as a CPA to the perks of remote and freelance positions.

Our Culture

Our Values

"Intuit is a purpose-driven, values-driven company. Our mission to power prosperity around the world is why we show up to work every single day to do incredible things for our customers. Our values guide us and define what we stand for as a company."

Sasan Goodarzi, Intuit CEO

The Intuit Expert Nework

The Intuit Expert Network is a dynamic community where tax and bookkeeping professionals connect, collaborate, and grow. Joining this vibrant network offers opportunities to learn from peers, access cutting-edge AI-driven technology, and build meaningful connections while helping clients navigate their financial lives with confidence.

Intuit is proud to be an equal opportunity employer. We make employment decisions without regards to race, color, religion, sex, sexual orientation, gender identity, national origin, age, veteran status, disability status, pregnancy, or any other basis protected by federal, state or local law. We also consider qualified applicants regardless of criminal histories, consistent with legal requirements. If you need assistance and/or a reasonable accommodation due to a disability during the application or recruiting process, please talk with your recruiter or send a request to TalentAcquisition@intuit.com.

For more information, please read our EEO policy. Intuit encourages people with criminal record histories to apply for employment, and values diverse experiences, including prior contact with the criminal legal system. To that end, Intuit welcomes such applicants in accordance with the California Fair Chance Act, Los Angeles City Fair Chance Act Ordinance, Los Angeles County Fair Chance Act Ordinance, the San Francisco Fair Chance Act Ordinance, and other similar laws. Philadelphia applicants can review information pertaining to Philadelphia’s Fair Criminal Record Screening Standards Ordinance here. Applicants for jobs in unincorporated areas of Los Angeles County can review a copy of the Los Angeles County Fair Chance Act Notice here.