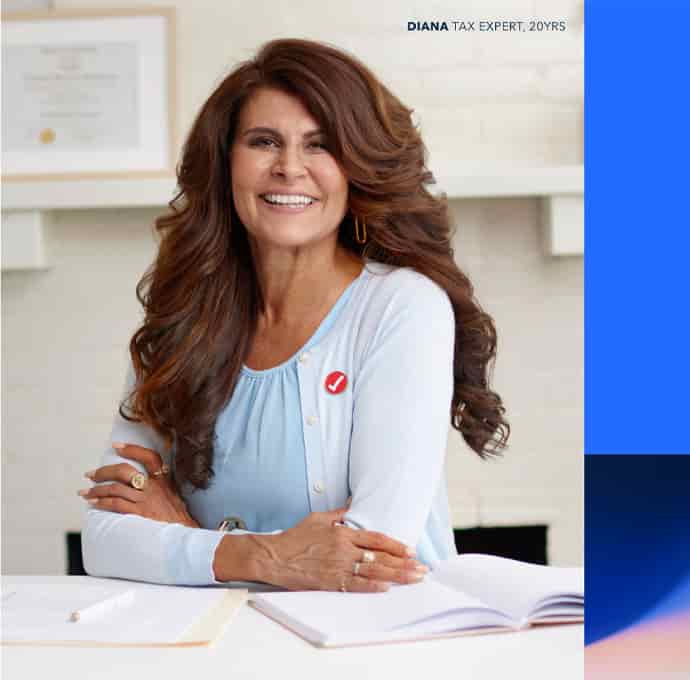

In a Tax Associate or Tax Expert role, you’ll be helping our customers do their own taxes by providing expert guidance, tax explanations, and advice so they can file confidently with TurboTax. For example, many of our customers need help with reporting deductions, rental properties, etc., and you’ll be the professional they turn to for advice and reassurance. In some cases you may prepare their return, sign, and file their taxes. You’ll also play an important role in our effort to enhance our brand by delighting our customers and empowering them to take control of their finances.