A small business owner in dire straits from the COVID-19 crisis needs financial relief—urgently.

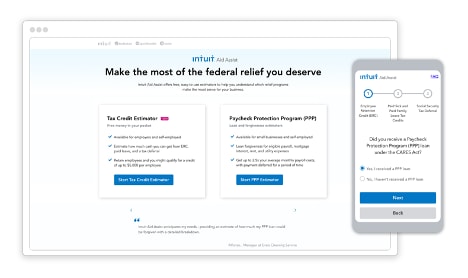

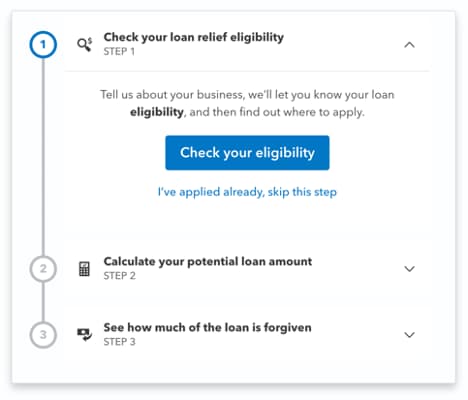

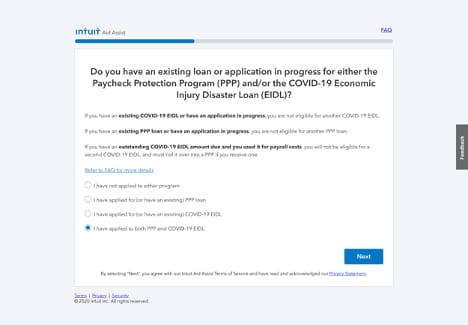

Rather than spending endless hours trying to decipher 800+ pages of complex rules in the CARES Act to figure out whether she qualifies for federal aid, she turns to Intuit Aid Assist, where she’s guided through a straightforward interview in plain language. Within minutes, she has clear answers to her most pressing questions: What relief am I eligible for? How much of a loan can I get? How much of my loan may be forgiven so I don’t have to repay it? Exploring every option available, she answers a series of questions to see how much she might qualify for in tax credits and deferments, gaining further insight into her financial situation.

Simple, intuitive experiences like these can make all the difference in empowering a small business owner. They’re made possible with Knowledge Engineering, a field of artificial intelligence pioneered by Intuit. By emulating the judgment and behavior of a human expert in a given field, Knowledge Engineering makes it possible to generate personalized experiences tailored to the user’s situation without sacrificing accuracy.

Here’s how Knowledge Engineering works, and how it’s delivering value for small businesses, consumers, and self-employed individuals.

Combining knowledge and data for the best of both worlds

In essence, Knowledge Engineering combines the power of rules-like knowledge with data. Since 2010— beginning with our TurboTax tax preparation software—we’ve advanced this technology for mission-critical financial compliance applications.

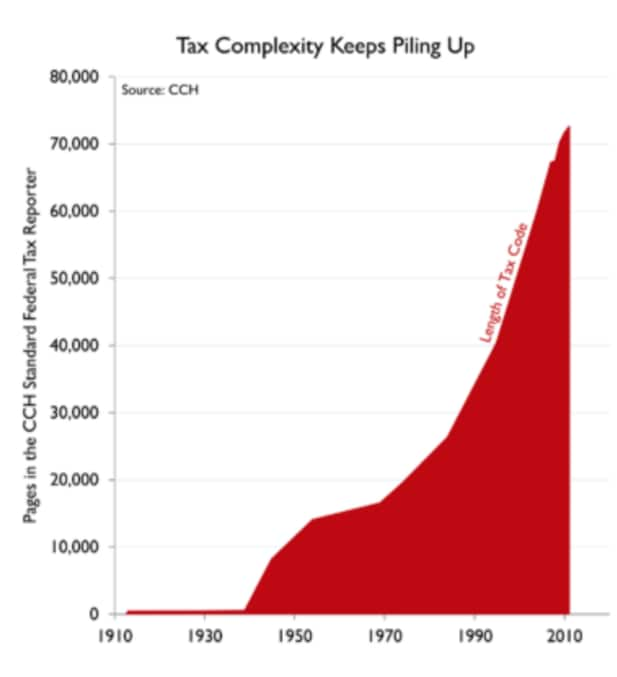

Because of the nature of the customer problems we solve, Intuit cannot accept the prediction errors and uncertainty inherent in purely data-driven approaches, such as deep learning. We also need to be able to explain clearly to customers exactly how we arrive at our results—for example, why they owe a tax payment this year. Adding to the challenge, compliance requirements change frequently. Based on a recent Thomson Reuters survey, a new compliance alert is issued every seven minutes around the world. Frequent changes in compliance laws mean there is little to no data that can be used to “learn” these changes ahead of time.

At the same time, using a classical knowledge-driven approach to AI, in which human experts manually curate financial rules, is simply not scalable. We’ve overcome this challenge by using natural language processing (NLP) and machine learning techniques to learn the rules. Over the years, we’ve developed a system that can automatically convert a high percentage of tax form instructions into knowledge engine-driven compliance software to power tax and other compliance applications. To ensure accuracy, an integral Knowledge Engineering pipeline allows human experts to review and correct any anomalies that the AI flags because of the low confidence score, or when they fail our stringent tests. With this framework, we are now more able to scale compliance solutions globally—an impossible feat if it were to be driven purely through manual Knowledge Engineering in isolation.

By codifying tax compliance requirements into machine-computable knowledge representation within the Intuit Knowledge Engine, we can potentially find misses and errors made by customers so that they can get every penny they deserve and avoid penalties.

Simplifying tax preparation and overtime compliance

The Intuit Knowledge Engine now plays a key role in the financial lives of millions of consumers and small business owners. Embedded within TurboTax, the platform correlates its understanding of 80,000 complex, frequently changing rules with each individual’s unique situation to find possible errors and omissions. Simple explanations—for example, why the filer does or doesn’t qualify for the Earned Income Tax Credit (EITC)—boost customer confidence in their experience. QuickBooks Payroll automatically notifies small business owners when they’ve made errors in overtime calculations, more than doubling the compliance rate among our customers—and helping them avoid possible $10,000 fines.

Using Knowledge Engineering to help customers access relief with Intuit Aid Assist

Knowledge engineering continues to help us solve new problems for small businesses and consumers. We brought Intuit Aid Assist online in just 21 days from idea to launch—an incredibly fast response to an urgent need. The Knowledge Engineering platform gave us a critical running start in this effort, making it possible to offer millions of people the help they need at a difficult time. Since the CARES Act was signed into law on March 23, 2020, we have simplified hundreds of pages of complex regulations into 5 – 10 simple-to-answer questions. Anyone can use the tool—not just Intuit customers—and get a clear understanding of their financial options.

Loan and forgiveness estimators for the Paycheck Protection Program (PPP) help small businesses and self-employed individuals determine their eligibility for loans of up to $10 million. Users can estimate both their maximum loan amount and how much of this might be eligible for forgiveness, helping them budget effectively and manage their spending accordingly The PPP estimator also lets users determine whether they qualify for the newly expanded Economic Injury Disaster Loan (EIDL) program, which allows applicants to use their credit score to get online approval for a wire-transferred advance of up to $10,000.

The Paycheck Protection Program (PPP) estimator

The Paycheck Protection Program (PPP) estimator

Even people who’ve been unable to qualify for a PPP fund might have options for tax relief—for example, individuals who have been sick with COVID or cared for someone who has been. Small businesses that received PPP loans may also be eligible for deferral of employer social security tax payments. As we continue to expand the resources available through Intuit Aid assist, a newly introduced tax credit estimator lets people use a simple questionnaire to navigate tax credits and deferments they might be able to file for in their next tax return. These include the employee retention credit (ERC), emergency paid sick leave credit, emergency family and medical leave, and employer Social Security tax deferral.

The Tax Credit Estimator

The Tax Credit Estimator

Together, the estimators available through Intuit Aid Assist can serve the needs of the 15 million self-employed individuals and 31 million small businesses across America. As one customer has said, “When every dollar counts as much as every minute, fear of financial risk or time wasted becomes very real. The tax credit estimator does a great job of breaking down complex rules and into digestible chunks. A few prompts helped me to navigate our next steps clearly and effectively.”

With more than a decade of work in Knowledge Engineering, we’ve made tremendous strides in enabling simpler, more personalized experiences for customers with the precision they need for critical financial applications. In the years to come, we’ll continue to harness the full potential of AI to speed innovation. We remain steadfastly committed to delivering value quickly—in the face of an ever-changing compliance landscape—to consumers, small businesses, and self-employed individuals.