At Intuit, our mission is to power prosperity, which is why we built Intuit for Education, a free financial literacy platform, designed to help Gen Z and Gen Alpha high school students become the most financially literate generations ever. To that end, Intuit is committed to our goal of helping 50 million students become financially literate by 2030, so that when they enter adulthood, they’ll already possess the financial knowledge they need to thrive and prosper.

Backed by Intuit’s 40-year history of helping people achieve financial confidence, high school students will benefit from a flexible and interactive curriculum with real-world tools that get them excited about taking control of their finances.

In this blog post, we’ll examine the purpose behind Intuit for Education, its key components, and how educators can leverage the curriculum.

Changing the Way Personal Finances Are Taught

I was lucky enough to grow up in a household that valued finance education, and my parents armed me with some valuable financial lessons and tools early on. However, for the majority of high school students, that’s not the case — today, only 1 in 4 high school students are required to take a personal finance course, and that number is significantly lower in low-income school districts.

Without a solid grounding in personal finance, young adults face significant financial challenges. Only 34% of individuals in the US can pass a basic financial literacy quiz, and that number is declining.

Intuit for Education aims to change the way personal finances are taught with a unique approach that helps students develop personal and entrepreneurial finance skills. This is brought to life through:

- Real-world tools to teach personal and entrepreneurial finance: Students have the opportunity to use real-world tools such as QuickBooks, TurboTax, Credit Karma, and Mailchimp to apply what they’ve learned to real-life scenarios—building a budget, filing their taxes, paying for college, or managing a side hustle.

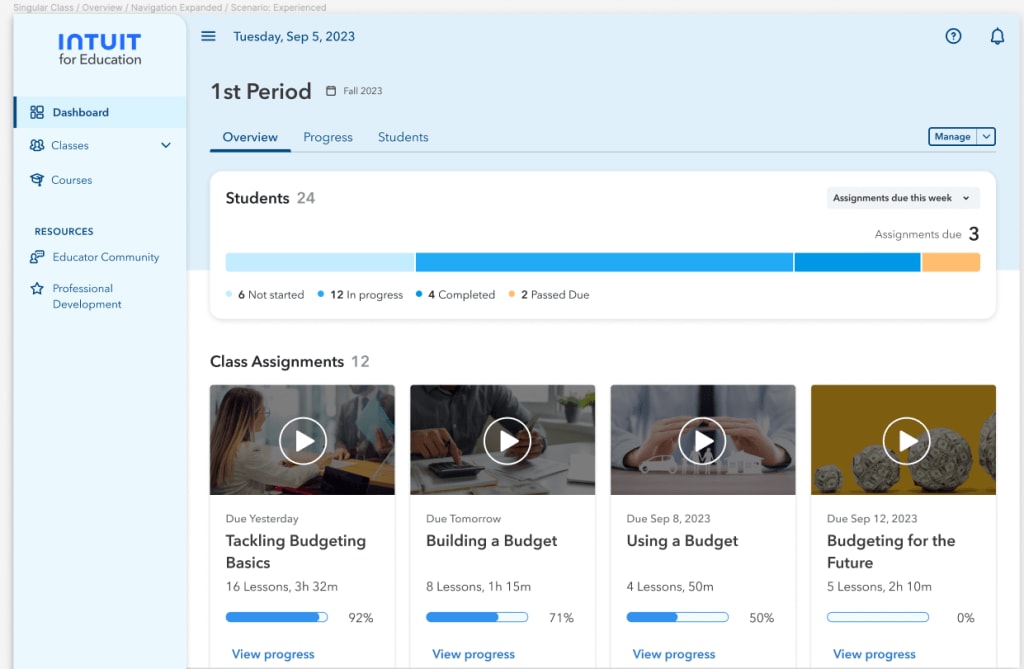

- Comprehensive and flexible curriculum: Educators can take advantage of 75+ hours of flexible and comprehensive curriculum, including 500 videos that can be customized to meet the unique needs of students. Content ranges from hour-long lessons that can be added to current curriculum, to full semester courses that meet national financial literacy standards with an industry-recognized certification.

- Interactive and engaging activities: Students can benefit from a variety of interactive activities, including: dynamic videos, simulations, reflections, drag & drop, quizzes, true/false, sort & order, and more. Educators can use the Web3D game, Intuit Prosperity Quest, as an introductory lesson to personal finance within Intuit for Education. The game allows students to explore concepts such as credit, loans, savings, and investments, to get them excited about financial education.

Here’s a closer look at the personal and entrepreneurial finance courses, which are designed at an 8th grade reading level to ensure accessibility across all high school students:

- Intuit Personal Finance course: This course provides students with the information they need to become financially literate as they move into adulthood, such as how to build credit, manage bank accounts, plan for investing, understand taxes, and repay loans. Students can apply these concepts and develop lifelong skills and capabilities by using Intuit product simulations in real-world scenarios.

- Intuit Entrepreneurial Finance course: This course is for students who plan to start a business or side hustle one day. The course includes concepts such as monitoring and forecasting business finances, managing risk, obtaining financing, and establishing a proper exit strategy. It can be taken as a standalone course or integrated into other external entrepreneurship programs.

Teachers, We’ve Got Your Back

In addition to a comprehensive and accessible curriculum, Intuit for Education comes with a robust library to help educators succeed, including how-to videos, teaching toolkits, webinars, professional development toolkits, and an engaged online community to help educators succeed.

To learn more about Intuit for Education, visit our website.