Understanding Gen Z Money: Trends and Spending Habits

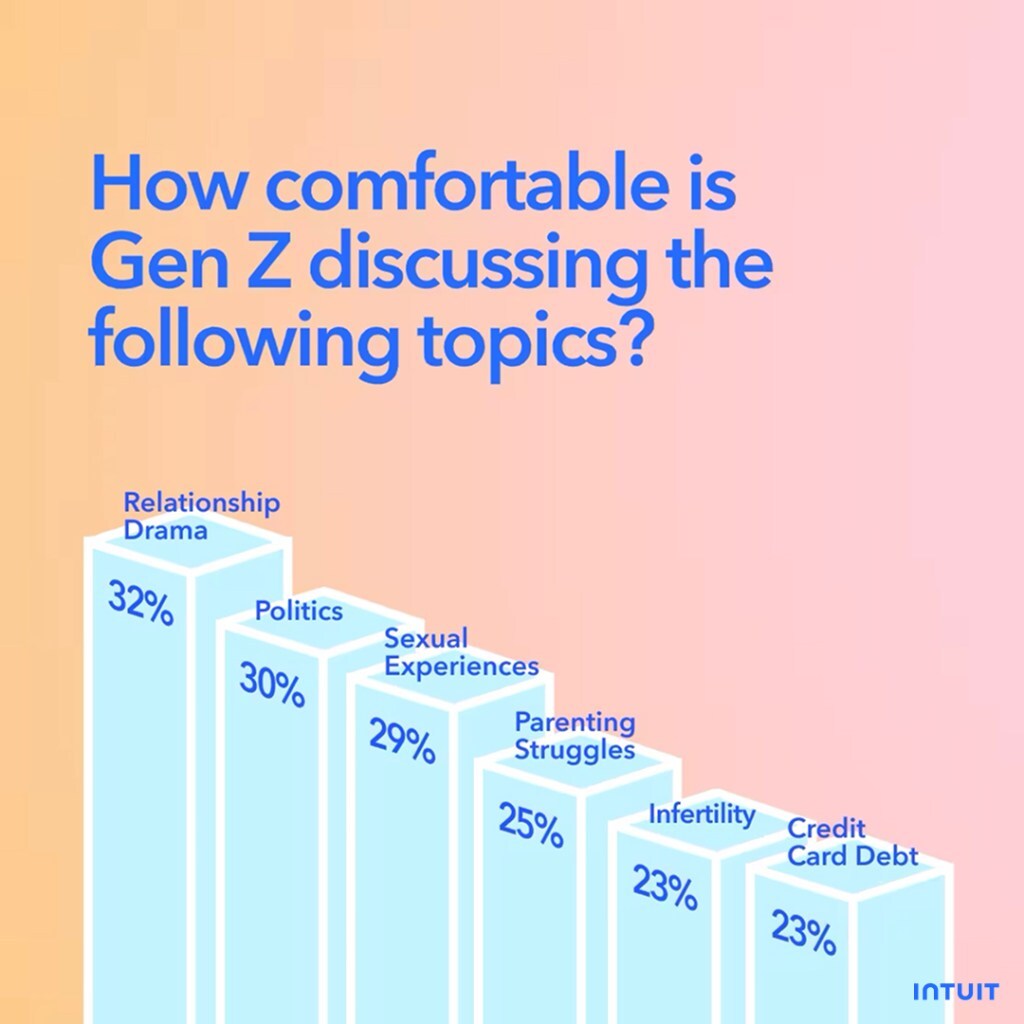

Gen Z would rather talk about absolutely anything but their finances. Members of the generation born between 1997 and 2012 would rather talk about virtually anything else—even sex or politics.

A survey from Intuit reveals interesting insights into Gen Z’s money beliefs and habits. And our findings extend beyond Gen Zers favoring other similarly taboo conversation topics. We also got a feel for how technology—social media trends, specifically—shapes how they save … or don’t.

Technology doesn’t always equal transparency, especially for Gen Z. When you’ve grown up with the ability to digitally alter your life and appearance with the click of a button, authenticity gets lost in the code. This is particularly true with finances.

Questions like “What is your salary?” or “How much is in your savings?” feel off limits, maybe even rude. But are they? Why does discussing one’s financial state strike fear into the hearts of so many?

Based on our data, it may have something to do with internet culture as a whole.

Gen Z would rather talk about anything but their finances.

Just as heavily doctored images of beauty on Instagram contribute to insecurities, “filtered finances” have a massive impact on 18- to 25-year-olds. Increasingly, honest conversations around formerly taboo subjects are the norm.

However, new data shows that Gen Z and money don’t mix. Adults from this generation would rather talk about politics, parenting struggles, sex, and infertility than debt, their salaries, and bad investments. In fact, despite their modern lives and outlooks, they are part of the 50% of Americans who would rather talk to their children about sex than speak to them about their own finances.

Soft saving minimizes stress.

Survey data also identified a new trend around Gen Z and their money, known as “soft saving.” It’s taken over TikTok feeds in recent years.

Think of soft saving as a financial spinoff of the boundary-setting “soft life” trend, which emphasizes comfort and minimizing stress. Soft saving is all about the now. It prioritizes spending on expenses that enrich your life in the present (like experiences or self-care) over long-term goals like retirement or home ownership.

A stark departure from the F.I.R.E. (Financial Independence, Retire Early) movement, hustle culture, and the Girlboss ethos dominating the past decade, Gen Z is embracing “soft saving.”

Nearly 3 in 4 Gen Zers say they would rather have a better quality of life than extra money in the bank.

True to their embrace of soft saving, nearly 3 in 4 Gen Zers say they would rather have a better quality of life than extra money in the bank.

In fact, experiences matter more than money to Gen Z, as 66% say they are only interested in finances to support their current interests.

Gen Z is troubled by conflicting advice.

Gen Z has more access to financial information than any other generation, but this doesn’t always simplify decision-making. From financial tips on TikTok to Reddit forums on investing, information overload around Gen Z money tips frequently paralyzes these young adults with conflicting advice.

Our survey data shows:

- Two-thirds say they know how to make a budget and track their income but haven’t done it (66%).

- Two-thirds know it’s important to invest, but they don’t know how (64%).

- 63% say they have financial knowledge but are unsure how to use it.

- Nearly half bought cryptocurrency even though they don’t fully understand blockchain (48%).

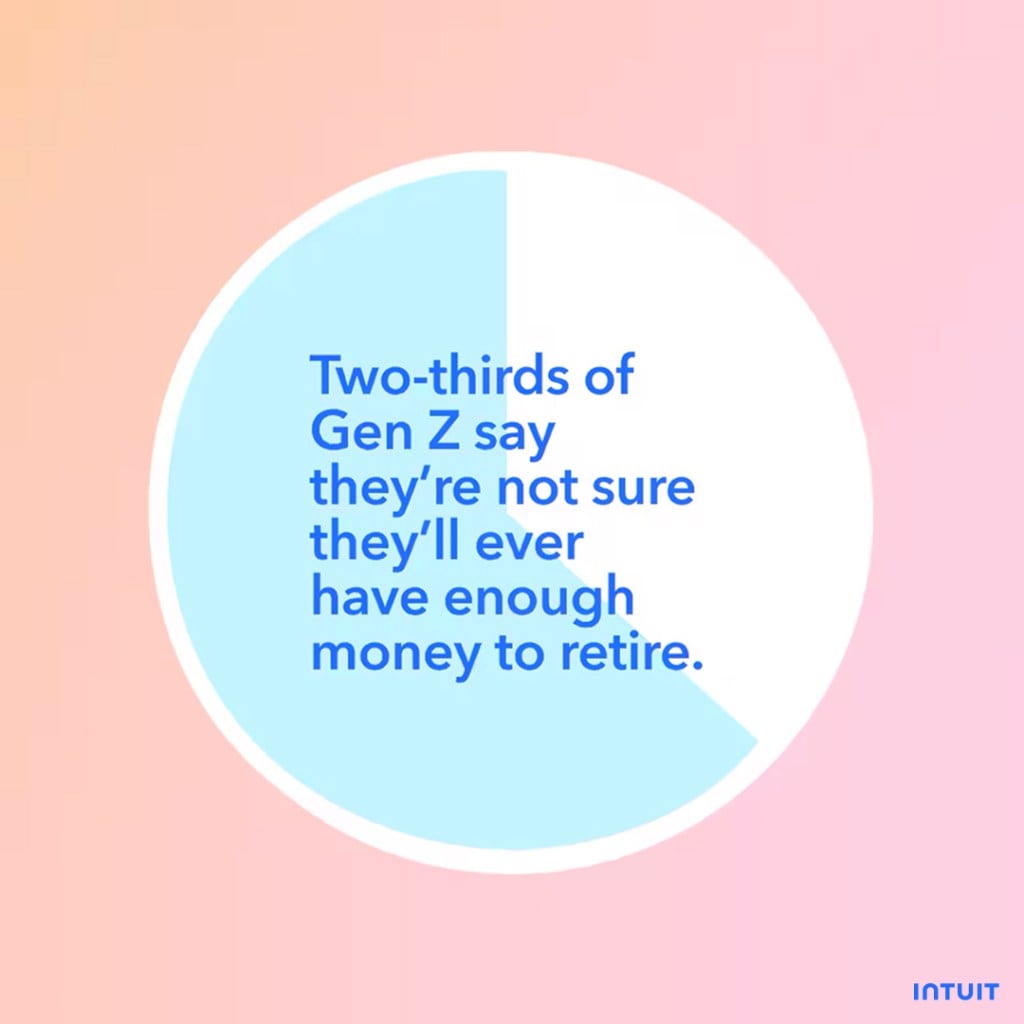

- Two-thirds say they’re not sure they’ll ever have enough money to retire (66%).

“The economic shocks of the last few years have transformed how Gen Z views success, and this survey revealed that prosperity means something different to everyone, particularly Zoomers,” said Brittney Castro, a consumer financial advocate who in the past served as a brand ambassador for Intuit products and services.

“Intuit … [believes] that everyone should be able to prosper—however they define that for themselves. Intuit delivers innovative and personalized financial solutions through TurboTax, Credit Karma, QuickBooks, and Mailchimp, which … customers need to make more money, save time, and build confidence.”

Additional Gen Z and money findings

Additional survey findings include:

- 67% of Gen Zers feel their quality of life is being held hostage by poor finances. They are the generation that values quality of life the most but constantly feel they will never have the things they want in life because of their financial situation.

- 57% of Americans feel anxious going with friends to restaurants and bars they know they can’t afford (70% for Gen Z).

- 54% of Americans say giving a gift for a special occasion would strain their monthly finances (66% for Gen Z).

- Nearly half of Americans (48%) say they’ve spent less time with friends or family due to financial constraints (61% for Gen Z).

Survey methodology

The Intuit Prosperity Index Survey was conducted Dec. 2-Dec. 9, 2022, via a 15-minute online questionnaire. Intuit surveyed 2,000 Americans ages 18+ plus an additional oversample of Gen Z (ages 18-25) to discover attitudes around money and personal finance.

Explore the full survey results here.

Bridging the financial gap for Gen Z

For Gen Zers, money isn’t everything. Although they understand it’s essential to achieving the life they want, many struggle to talk openly about their finances. This hesitation can make it more challenging to learn and solve money problems as they enter adulthood.

Regardless of age, understanding your financial situation and how to improve it is critical to your success in life. The obstacle many people face is a lack of knowledge.

Fortunately, Intuit is here to help. Explore our library of financial literacy resources to learn more about everything from basic budgeting and saving to investing and taxes.