At Intuit, proud maker of TurboTax and QuickBooks we believe that everyone deserves the opportunity to prosper. We’re dedicated to providing the tools, skills, and insights that empower people around the world to take control of their finances and live the lives they want.

The future can be hazardous to your financial health.

Your numbers might look good today, but what if tomorrow brought a cluster of payments due that suddenly dropped your cash flow into the red? What if an unexpected event or change in circumstances impacted your finances, requiring you to sacrifice your values or lifestyle? What if such extenuating circumstances eroded your bank account balance with exorbitant overdraft fees?

At a time when 40 percent of Americans wouldn’t be able to cover a $400 emergency, the unfortunate reality is that millions of people face financial challenges like this every day.

Today’s advanced technologies can help mitigate the impact of unexpected shortfalls and contribute to financial resiliency, increasing the odds that an individual can bounce back faster from setbacks when they occur. In this blog series, I’ll describe three ways that Intuit data scientists, engineers, and designers are putting artificial intelligence (AI) and machine learning (ML)—combined with psychology-based design—to work for our customers, starting with a small business example.

Avoiding small business cash flow crunches

More than half of small businesses fail within the first five years. Often, this is not the result of a flawed business model or failed product, but simply a lack of cash flow. A majority of small business owners spend inordinate amounts of time trying to manage their cash flow using time-consuming manual spreadsheets. Even then, it’s all too easy to be caught short, as you can see in the results of our State-of-Cash-Flow Survey Report.

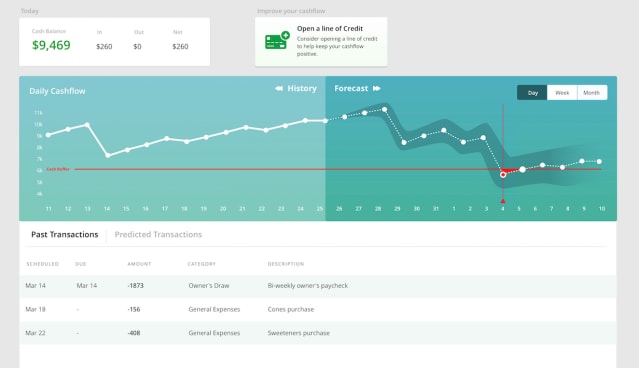

That’s why we’re developing a cash flow forecasting engine to automate the process for our customers. Using historical user data and breadth of data from similar businesses, we’ve discovered how to use AI/ML to identify telltale patterns and make accurate, personalized cash flow predictions. In this example, AI/ML techniques such as predictive intelligence, time series modeling, transfer learning and deep learning can empower small businesses to make better financial decisions.

Consider a small business owner who’s recently opened an ice cream shop. She reviews her recent history in the Intuit cash flow tool and sees that income has been exceeding expenses, as it should. So far, so good—but the future forecast shows cause for concern. Based on an analysis of the shop’s cash-in and cash-out transactions, the algorithm predicts that her cash balance will soon dip below her recommended cash reserves, a precarious position to be in. Although income is expected to remain consistent, her monthly lease payment will come due at around the same time as several other expenses, including some billed on a bi-monthly, quarterly, or semi-annual basis—the first time these payments have overlapped in this way.

In the past, this unanticipated combination of expenses could have been highly destabilizing to the financial health of this fledgling business. In the future, the business owner will be able to foresee the coming cash crunch and take steps to mitigate it: for example, by adjusting the amounts and dates of bill payments and auto-pays, reducing her owner’s draw, or making an informed decision to accept a temporary dip in cash reserves in light of the approaching busy season for her store.

Beyond helping avert cash flow-related setbacks, AI/ML predictions can help small business owners grow with confidence. As our ice cream shop owner gains experience and her business thrives, the cash flow tool shows healthy finances moving forward, taking into account the specific seasonality of the ice cream business to accurately predict both sales and expenses over the summer. As she starts thinking about the next step, a scenario modeling tool provides a clear way to evaluate her options—including both the potential viability of a second store and the predicted cash flow associated with various available locations.

This is just one way Intuit is putting AI/ML technology to work to help our customers’ future-proof their finances. As a company whose mission is powering prosperity, our technologists are proud to play a part in helping today’s small business owners break the statistical 5-year barrier to successfully build thriving businesses that contribute to the long-term growth and vitality of our economy.