Let’s be honest: The prospect of learning how to budget doesn’t usually spark excitement.

If we had to guess, that’s probably because budgets are often synonymous with limitations. But a well-crafted budget is actually more freeing than restraining. It’s your ticket to understanding and controlling your money.

The beauty of budgeting lies in its flexibility. There’s no one-size-fits-all approach. The right method is waiting for you, whether it involves tech-forward apps or simple spreadsheets.

And the best part? You don’t need to be a math whiz or a financial guru. Budgeting is a skill anyone can learn and master. Here’s how to create a budget in seven simple steps.

Learning how to be on a budget

Budgeting isn’t about restricting your spending or depriving yourself of life’s pleasures. It’s about gaining clarity and control over your finances. Think of it as a financial roadmap that helps you spend intentionally, cover your living expenses, and achieve your goals.

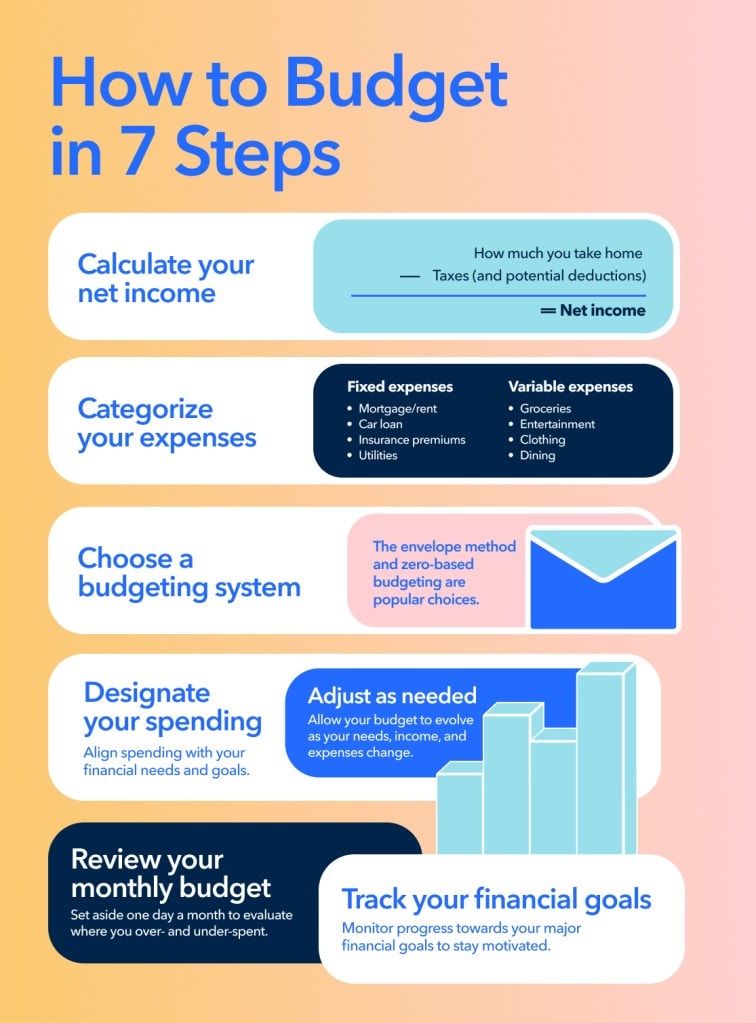

Let’s break down the budgeting process into seven key steps.

1. Calculate your net income

The first step of being on a budget is determining your net income—the money you bring home after taxes and other deductions. This figure is the foundation of your budget—the amount you have available to work with each month.

For salaried employees, this is typically straightforward. It’s the amount that appears on your paycheck.

However, calculating your net income might require more effort if you’re self-employed, have multiple income streams, or work on commission. In these cases, it’s helpful to average your income over the past few months to get a realistic figure.

Account for all sources of income, including:

- Your primary job

- Side hustles

- Investment dividends

- Rental income

- Any other regular sources of incoming money

An accurate picture of your total income sets you up for budgeting success. After all, you can’t plan your spending if you don’t know how much you’re earning.

2. Categorize your expenses

Once you’ve nailed down your income, focus on where that money goes. Categorizing your expenses helps you see exactly what you have and where every dollar goes.

Start by listing all your fixed expenses. These are the predictable, recurring costs, such as:

Next, move on to your variable expenses. These include money spent on things like:

- Groceries

- Entertainment

- Clothing

- Dining out

Also, don’t forget occasional expenses like car maintenance or holiday gifts. Budget for these by setting aside a small amount each month.

Creating categories that make sense for your lifestyle is key. Some people prefer broad categories like “Food” and “Transportation,” while others benefit from more specific ones like “Groceries,” “Dining Out,” and “Gas.”

The goal is a system that gives you a clear view of your spending patterns but isn’t too complicated.

3. Choose your budgeting system

With your income and expenses mapped out, it’s time to choose a budgeting system that works for you. This is where personal preference comes into play. What works for your best friend might not be the best fit for you. For example, you can prioritize your savings with the 80/20 rule, or keep a close eye on where every dollar of your income is going with a zero-based-budgeting strategy.

4. Designate your spending

This is where you align your spending with your financial needs and goals. This step is about making intentional choices about where your money goes rather than wondering where it went at the end of the month.

Start by covering your needs—housing, utilities, groceries, and other essentials. Then, allocate funds for your financial goals, whether that’s building an emergency fund, paying off debt, or saving for a major purchase. You can designate what’s left for fun stuff like entertainment, hobbies, or dining out.

Be realistic with your allocations. If you love trying new restaurants, it’s OK to budget for that, but you might need to balance it by cutting back on other areas. The goal is to create a sustainable plan you can stick to.

5. Adjust your categories as needed

Mastering how to budget is an evolving process that requires tweaks and adjustments as you go. As you track your spending, you might realize that some of your initial estimates were off. Or your priorities might shift.

For example, maybe you budgeted too little for groceries and too much for entertainment. Or perhaps you got a raise and want to increase your savings rate. Or life changes—things like moving to a new city, starting a family, or changing jobs—might call for budget adjustments.

What you want is a budget that accurately reflects your current lifestyle and financial goals. Regularly review and adjust your budget categories to make that happen.

6. Review your budget monthly

Consistency is crucial in budgeting. To that end, a monthly review is a habit that’ll serve you well. Set aside time each month (perhaps on the last day of the month or payday) to review your budget performance.

During this review, compare your actual spending to your budgeted amounts in each category:

- Did you stay within your limits?

- Where did you overspend?

- Where did you underspend?

This isn’t about beating yourself up if you miss the mark. It’s about understanding your patterns and making informed decisions.

Use this monthly check-in to celebrate your successes, no matter how small. Did you save a little extra this month? Great! Did you avoid overspending on dining out? Fantastic! Acknowledging wins can help keep you motivated.

This is also the time to make necessary adjustments for the coming month. Maybe you know you have a birthday dinner coming up or that your utility bills will be higher due to seasonal changes. Proactively adjust your budget to stay on track and avoid surprises.

7. Track your financial goals

A budget’s ultimate purpose is to help you achieve your financial goals. You might be saving for a down payment on a house, planning for retirement, or working to become debt-free. A budget is your ally in making those dreams a reality.

Start by clearly defining your short- and long-term financial goals. Short-term goals might include building an emergency fund or saving for a vacation. Long-term goals could be building your retirement savings or children’s education fund.

Incorporate these goals into your budget by treating them as essential expenses. Just as you budget for rent or groceries, budget for your financial goals. This might mean setting up automatic transfers to a savings account or increasing your retirement contributions.

Track your progress toward these goals regularly. Seeing the balance in your savings account grow or watching your debt decrease can be incredibly motivating. If you’re falling short, reassess your budget to identify where to make changes.

Tips for making budgeting easier

Creating and sticking to a budget doesn’t have to be a chore. With the right approach and tools, it can become a seamless part of your financial routine. Here are some tips to make budgeting easier and more effective:

- Use technology: Explore budgeting apps and software that can automate much of the process. These tools can categorize your expenses, track your spending, and even provide insights into your financial habits. Some popular options include:

- Expense tracking apps that link to your bank accounts

- Spreadsheet templates with built-in formulas for budget calculations

- Personal finance software that offers comprehensive money management features

- Use the envelope system: For those who prefer a more tangible approach, the envelope system can be highly effective. Allocate cash for different spending categories into separate envelopes. When an envelope is empty, you know you’ve reached your spending limit for that category.

- Try a “no-spend” challenge: Designate a day, week, or even month where you commit to not spending money on nonessential items. This can help reset your spending habits and identify areas where you might be overspending.

- Automate your savings and bill payments: Set up automatic transfers to your savings account and automatic bill payments. This helps you stay on track with saving and avoid missing payments.

- Use the 24-hour rule for purchases: Wait 24 hours before buying nonessential items, especially larger purchases. This cooling-off period can help you distinguish between needs and wants to avoid impulse spending.

- Meal plan and prep: A significant portion of many budgets goes toward food. Plan your meals for the week and prep them in advance to save money. This helps you stick to your grocery budget and avoid spending too much on takeout or dining out.

- Use visual aids: Create charts or graphs to visualize your budget and financial progress. Seeing your debt decrease or savings increase can be a powerful motivator.

- Find an accountability partner: Share your financial goals with a trusted friend or family member. Regular check-ins with an accountability partner can help you stay motivated and on track.

- Educate yourself: Learn more about personal finance. Books, podcasts, or financial literacy websites are all great resources. The more you understand about money management, the more confident you’ll become in your budgeting skills.

Creating a budget with Intuit

Budgeting is a powerful tool for controlling your finances and achieving your goals. By following the steps we’ve outlined—from calculating your income to tracking your progress—you can create a budget that works for you. Remember, budgeting is a skill that improves with practice, so don’t get discouraged if it takes some time to get it right.

Intuit is here to support you every step of the way on your budgeting journey. With our range of financial literacy tools and educational resources, we’re committed to helping you build a strong financial foundation. Whether you’re just starting out or looking to refine your budgeting skills, Intuit is here to help you succeed.

This blog is a chapter within Intuit’s personal budgeting guide. Visit our hub page to explore more topics and learn about budgeting basics.