Welcome to 2025, where younger generations are prioritizing wellness over wealth—specifically, financial wellness. The focus is no longer solely on accumulating wealth but on achieving financial wellbeing. Gone are the days when big paychecks defined success; today, mental clarity, peace, and control over money matters take precedence. This transformation reflects a broader cultural evolution, advocating for sustainable financial wellness over riches. It underscores a growing recognition that true success extends beyond earning capacity to encompass self-care, fostering relationships with money that nurture happiness and contentment. This shift in popular thought continues to influence, encouraging a holistic view of wealth that aligns with personal values and long-term life satisfaction.

According to Intuit’s latest consumer survey, Beyond the Budget: How Younger Generations Are Easing Stress with Financial Wellness Habits, 58% of 18-35-year-olds are integrating financial management into their overall wellness routines. Significantly, 44% report improvements in their quality of life since embracing financial wellness, illustrating that even small adjustments can lead to substantial benefits. Discover how money savvy and budget conscious Gen Z and Millennials are thinking about financial wellness — and the small steps you can take to join the movement.

The State of Financial Stress

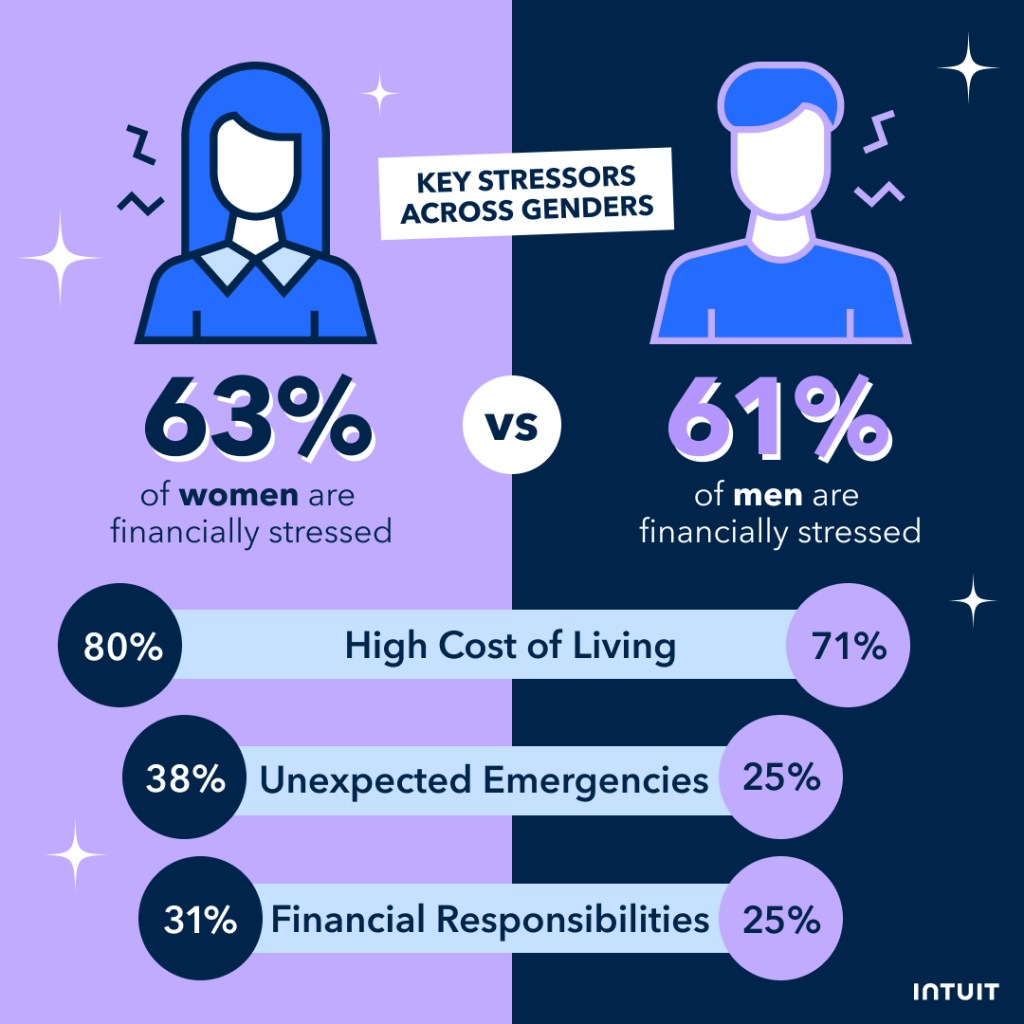

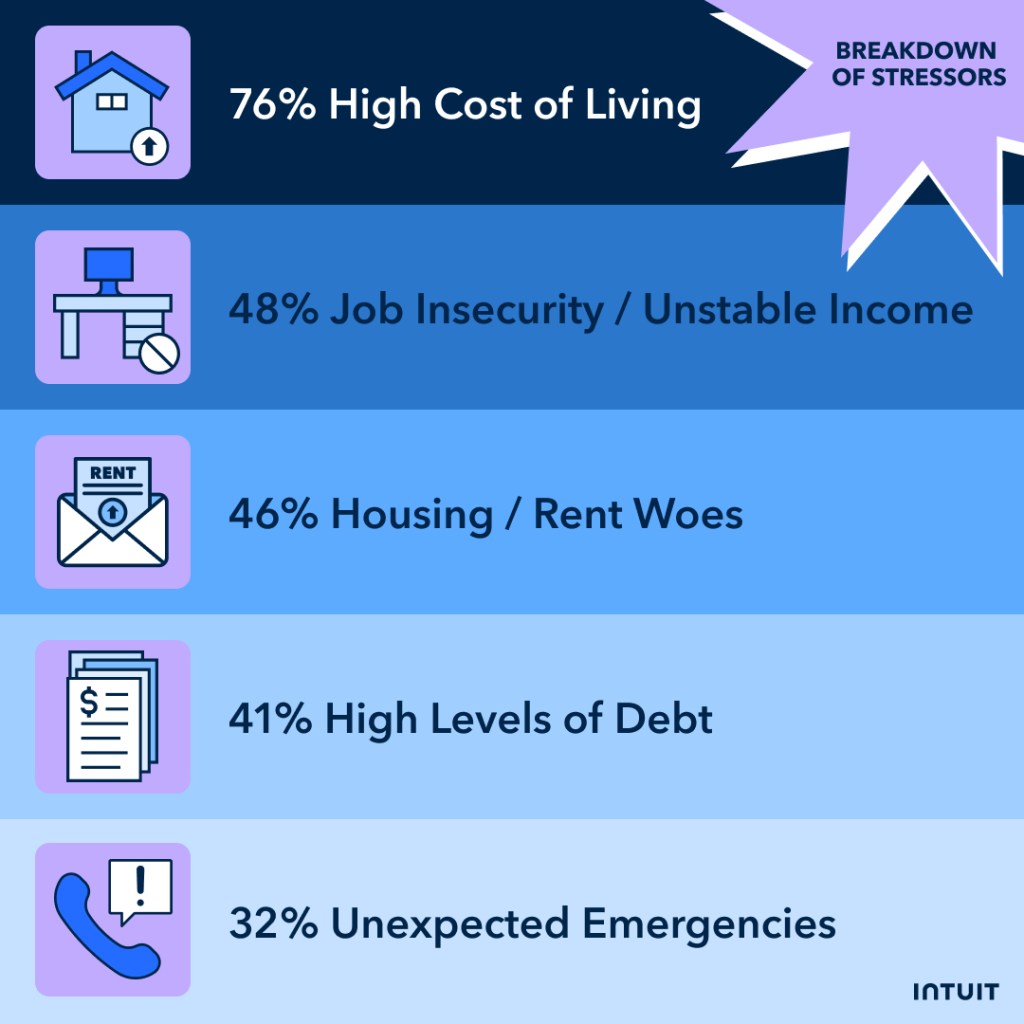

You’re not alone if you’re feeling anxious about money. With the cost of living rising, debt mounting, and unexpected expenses impacting many, it’s hardly surprising that financial stress is affecting 61% of 18-35-year-olds. Women and Black and Latino communities are particularly impacted, many of whom report that their financial anxiety has worsened over the past year.

The primary culprits of this stress? A sharp increase in the cost of living (76%), job instability (48%), and escalating housing expenses (46%) lead the concerns. In a recent conversation with my Gen Z sister and a group of her friends—all recently graduated from college—I inquired about the financial issues that weighed most heavily on them. Among the four women present, the thought of earning a sustainable living and potentially never becoming homeowners was a prevailing source of unease.

Reflecting on my own journey as a millennial homeowner, I recall the uncertainty I felt about the feasibility of homeownership. It was only through family support, partnering with someone well-versed in finance, and pooling our resources that I managed to navigate this significant life milestone in my early thirties. This dream can still be a reality for younger generations. Having a clear plan of action, along with researching available tax deductions and credits, can significantly aid your path to homeownership and ensure you are making the most financially sound decisions on your journey.

Challenges in Achieving Financial Wellness

While a growing number of people are emphasizing financial wellness, 32% of survey respondents admit they don’t have a clear strategy for managing money setbacks. The most significant challenges include living paycheck to paycheck (49%), handling unexpected expenses (45%), and difficulty saving (29%). Women and communities of color encounter even steeper obstacles, with 38% of women reporting insufficient emergency savings, compared to 25% of men. Despite these hurdles, adopting small, intentional actions such as budgeting, building extra income, or practicing value-driven spending by living below your means has proven effective in overcoming these barriers and creating a more durable financial foundation.

Many individuals are navigating similar financial waters, and connecting with others’ experiences can provide encouragement and a sense of community. Consider the story of Intuit intern Eileen Kang, who turned her passion for jewelry-making into a profitable side hustle to support herself through college.

The Rise of Generation Side Hustle

Amidst financial stress, people are discovering creative ways to get ahead. One of the most popular strategies? Side hustles. According to Intuit data, over 41% of Gen Z and Millennials find that engaging in side hustles or additional income streams has significantly boosted their financial wellness. These efforts are more than just short-term fixes; in fact, 31% of individuals are targeting side hustles as their #1 financial goal for 2025. Whether it’s freelance work or passion projects, side hustles offer a tangible method to increase income, build savings, and improve financial stability.

Intuit’s recent survey of 18-35-year-olds, “The Side Hustle Generation: Gen Z and Millennials Redefine Financial Success,” reveals that nearly two-thirds of respondents have initiated or are planning to start a side hustle to complement their primary income. Even more indicative of a lasting trend, 65% of them intend to continue their entrepreneurial endeavors in 2025. These are not just fleeting trends but signify a profound shift in how younger generations view work, purpose, and financial independence.

Money Talks and Wellness Routines For Financial Self Care

Talking about money has long been seen as taboo, but that’s starting to change. According to our consumer survey, 65% of people want to have more open conversations about money, and it’s easy to see why. Money impacts every aspect of our lives — from our daily choices to our mental well-being. In fact, 55% of people believe their physical and mental wellness are directly tied to their financial wellness. One way people are breaking the silence? Creating a financial wellness routine.

More than half (58%) of Americans have made money management a key part of their overall self-care routines, and it’s paying off. 36% of people report feeling less financial anxiety since starting a routine, and 41% say creating a budget and sticking to it has had the biggest impact on improving their relationship with money. While some are still missing out on this aspect of self-care (28% have yet to create a financial wellness routine), the growing push to normalize open money talks is helping people feel more comfortable discussing their finances with friends, family, and even coworkers.

Outlook for 2025: A New Era of Financial Wellness

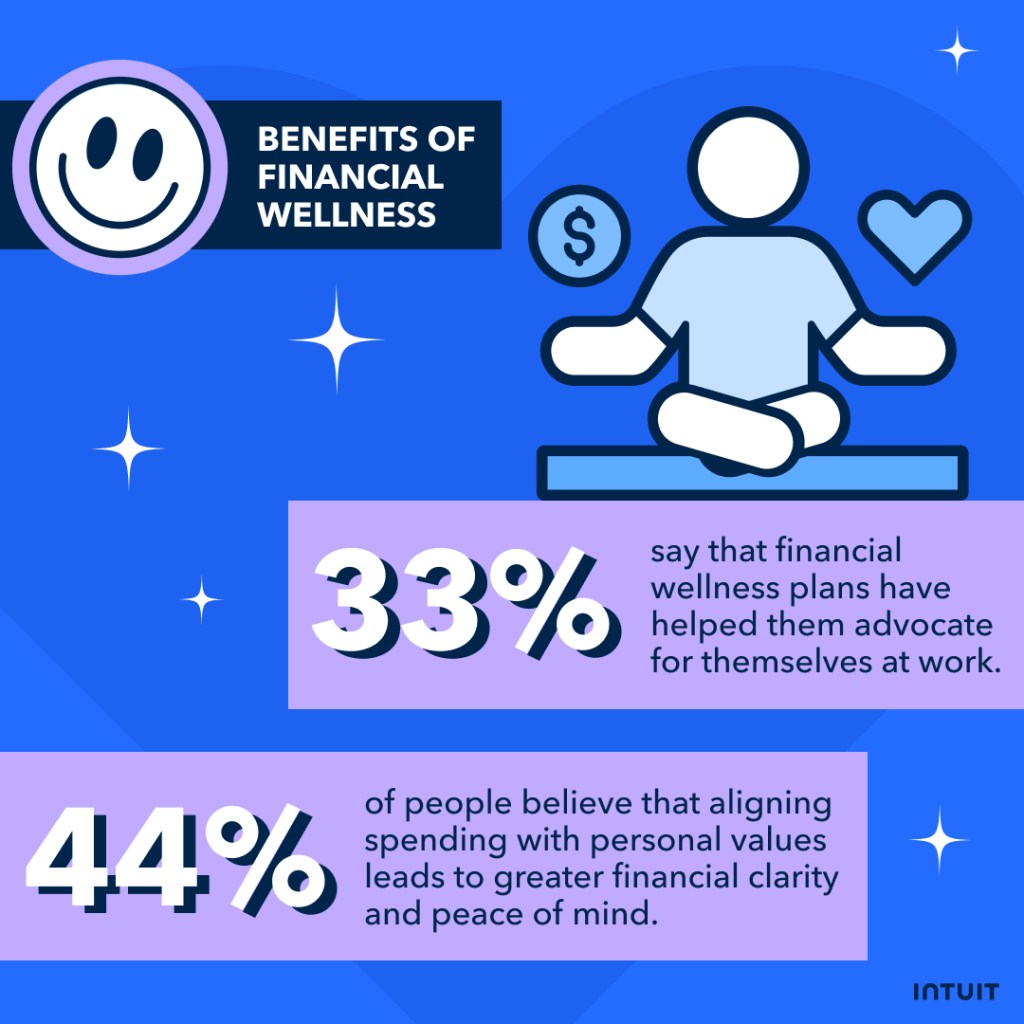

The movement toward financial wellness and self-care is rapidly gaining traction, as an increasing number of individuals emphasize structured financial routines, entrepreneurial side hustles, and transparent discussions about money management. This cultural shift is already yielding significant impacts—33% of respondents assert that targeted financial wellness strategies have empowered them to advocate more effectively for themselves in the workplace. Furthermore, 44% report that aligning their spending with their personal values has not only simplified financial decisions but also enhanced their overall financial peace of mind. As access to financial education broadens, with free tools like Intuit for Education, anticipate that Gen Z and Millennials will persist in redefining the traditional concepts of wealth, shaping them to fit their values and lifestyle preferences more authentically.

Survey Sample and Methodology: In December 2024, Intuit commissioned an online survey of 2,000 U.S. consumers age 18-35 years old. The survey focused on uncovering consumer trends and insights among Gen Z and Millennial demographics, with a particular emphasis on their perspectives on financial habits, spending, and financial wellness routines. Percentages have been rounded to the nearest decimal place, so values shown in data report charts and graphics may not add up to 100%. Responses were collected using Pollfish audience pools and partner networks with double opt-ins and random device engagement sampling to ensure accurate targeting and results. Respondents received remuneration.