Minding the Gap: Uncovering the Gender Divide in Financial Literacy

Data from the 2024 Intuit Financial Literacy Survey lifts the lid on an important trend: women are less likely than men to feel confident about their finances. This isn’t just a personal issue; it’s a major roadblock standing between women and their life goals, their dream businesses, and their ability to handle everyday money worries. The survey shines a spotlight on the uncomfortable truth about money — it’s still a taboo topic, especially for women — and explores the consequences financial stress and disparities have on financial prosperity and overall well-being.

Findings at a glance:

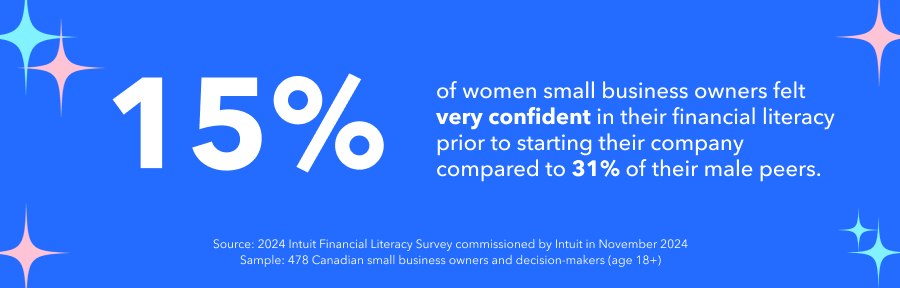

- Many women face barriers to financial success, with 55% of women surveyed wanting to improve their financial literacy, and just 15% of women small business owners feeling very confident in their financial knowledge before launching a business.

- Financial insecurity is a pressing concern, with only 38% of women having 3 or more months of savings and 19% of women-owned businesses possessing adequate cash reserves to navigate unforeseen financial challenges for 6+ months.

- Financial stress is widespread, affecting 57% of consumers surveyed, with women (61%) and Gen Z (71%) disproportionately impacted; plus, nearly a quarter of small business owners (23%) feel less financially confident than their peers — and among women, this rises to 26%.

- The stigma surrounding money talk persists, with 22% of consumers feeling uncomfortable discussing finances in social settings. This discomfort is particularly pronounced among women (27%) and women small business owners, of whom 15% confess they find it easier to talk about their sex lives than finances.

- Women are taking their financial education into their own hands with personal research providing their biggest financial lessons (29%) and nearly half of women entrepreneurs (47%) turning to social media platforms for financial advice.

The financial confidence gap is holding women back

Financial literacy can be a gateway to achieving both personal and professional goals. But survey data indicates the gender gap in financial confidence persists. While half of all consumers surveyed indicate a desire for a deeper understanding of their finances (52%), more women are affected by this knowledge gap than men. More than 1 in 2 women surveyed (55%) said “I wish I understood more about my finances, but I don’t know where to start” versus 49% of men. This gap makes it more difficult for such women to achieve life goals, such as saving for retirement (51%), reducing debt (41%), and balancing daily expenses (41%).

The divide is just as apparent among small business owners, with only 15% of women feeling very confident in their financial management experience before launching their companies compared to 31% of men. This disparity throws a wrench in scaling up for over a quarter of women who lacked financial confidence, with 27% saying their financial literacy struggles negatively impacted business growth.

Back to top

The gender divide on financial (in)security

The survey reveals other financial disparities between men and women. For example, only 38% of women say they have enough savings to cover 3 or more months of expenses, trailing behind men at 47%. The situation is especially urgent for younger consumers, with just 28% having a sufficient financial cushion of 3 or more months of savings. Banking decisions can significantly impact financial preparedness, but a clear gender divide emerges here, too. With less savings, women are keeping a closer eye on their wallets when choosing a bank — with account maintenance and transaction fees being their primary concern (52%). On the flipside, men are most concerned about a bank's reputation and stability (53%).

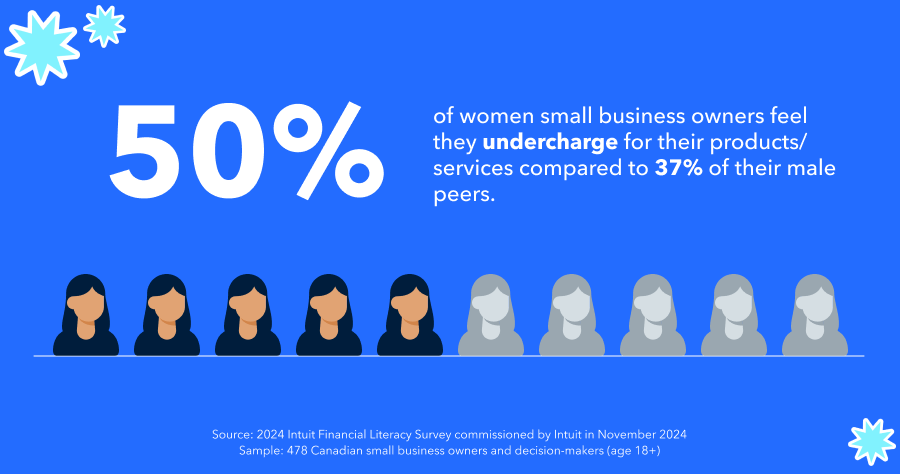

Gender disparities in financial security don't stop with consumers. Less than a quarter of small businesses have enough cash reserves to cover 6 or moreat least 6 months of operations (23%), and financial insecurity is felt more by some than others. Only 19% of women-owned businesses have this safety net compared to 29% of male-owned businesses, potentially leaving them more vulnerable in uncertain times. This vulnerability may be further compounded by pricing strategies. Half of women small business owners feel they undercharge for their products or services (50%), compared to 37% of their male peers. And when it comes to deciding what’s the right price for success, women are most likely to base prices on competitors (57%), while men are most likely to rely on perceived market value (56%).

The heavy toll of financial stress

Financial worries aren't just a minor inconvenience; they can be a heavy burden impacting mental and physical health. Two in 5 consumers report feeling less financially confident than their peers (41%), with women and Gen Z particularly affected. This insecurity isn't just a matter of perception; it's translating into tangible stress, with over half of all consumers reporting financial stress in the past month alone (57%). For women, this figure jumps to 61%, and to 71% for Gen Z respondents. In the last month alone, 43% of women reported experiencing anxiety or depression due to money woes, while 36% struggled with sleep and 21% say it has strained their relationships. The pressure is so intense that for 38% of women (compared to 34% of men) and 53% of Gen Z respondents, managing personal finances is more stressful than a job interview.

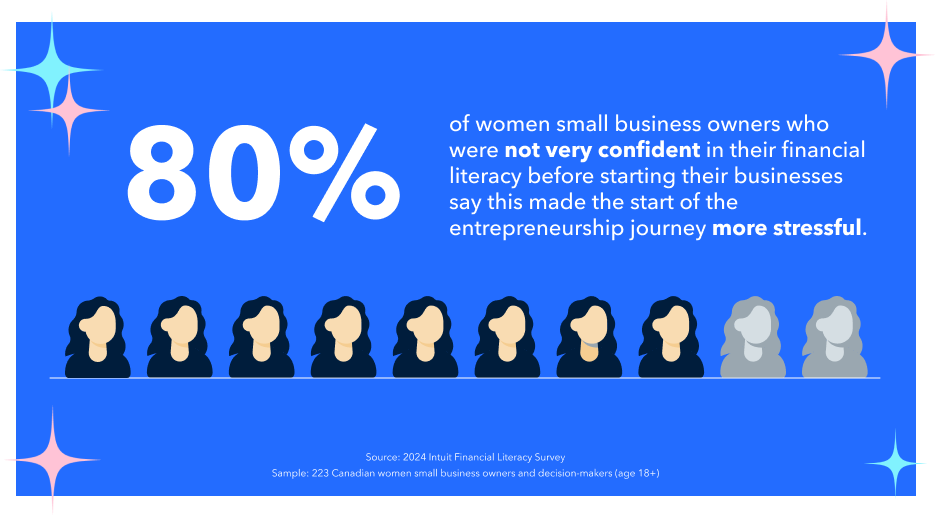

Small business owners expressed similar concerns. Nearly a quarter admit feeling less financially confident than their peers (23%), with women entrepreneurs particularly vulnerable at 26% compared to 19% of their male counterparts. For women entrepreneurs already grappling with financial literacy, this lack of confidence adds a significant layer of stress. A majority say their financial knowledge gap made starting a business even more stressful (80%).

The pressure of managing business finances takes a heavy toll on women entrepreneurs in particular, with 1 in 3 citing it as one of the most stressful parts of their day (33%). Financial worries have contributed to a quarter of women entrepreneurs experiencing anxiety or depression over the last month (25%). Similar numbers report struggles with sleep (22%) and maintaining a healthy work-life balance (21%).

The taboo of talking about money

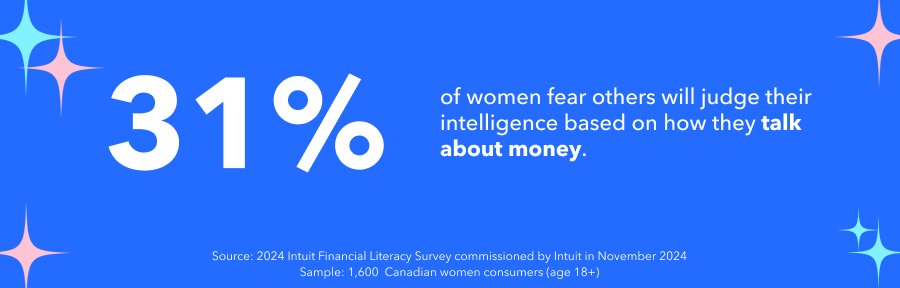

Money talk can be awkward, and for many, it's a subject they'd rather avoid. While 87% of women talk about money with their closest friends and family members, 27% feel uneasy talking about money in social settings. This is compared to just 17% of men who say the same. One in 5 women say they’re more comfortable talking about sex than money (22%). This financial taboo is more prevalent among Gen Z respondents, with 34% finding it easier to discuss their sex lives than their bank accounts. While open conversations about money can be crucial for breaking down stigma and improving financial literacy, the fear of judgment remains a significant barrier. Nearly 1 in 3 women worry that others will judge their intelligence based on how they talk about money (31%), making discussions around finances challenging and uncomfortable for some.

Similar trends are evident among women small business owners and decision-makers. Although 90% of women entrepreneurs chat about money with close friends and family at least a few times a year, almost 1 in 4 fear being judged based on their financial acumen (23%). While the majority of small business owners are comfortable discussing money in social settings (56%), women are notably less at ease. One in 2 women entrepreneurs are open to these conversations (51%), compared to 3 in 5 men (63%). Despite half of women entrepreneurs responding they’re comfortable discussing money, discomfort persists. More than 1 in 10 (15%) confess they find it easier to talk about their sex lives than finances.

Today's money 101 is a mix of school and social media

When it comes to financial know-how, 7 in 10 consumers report receiving some finance education during school (71%). Gen Z is pushing progress forward with a significantly higher 82% saying they learned some money smarts during their formal education. Despite some advancement, less women reported receiving financial education in school compared to men (68% vs. 73%).

But even with formal education, it's clear that hands-on experience is king. On average, most Gen Z respondents’ biggest financial lessons came from their parents or family members (29%), with a quarter being self-taught (26%). Similarly, women are hitting the books (and the internet) hard with most of their biggest financial lessons coming from personal research (29%) on average. Women are also turning to social media, with 2 in 5 saying social media is a source of financial advice (41%) to manage their personal finances. And the platform of choice? YouTube, where nearly a quarter of women (24%) are getting their money tips. Gen Z is also tuning in with 68% using social media for financial education and 45% favoring YouTube, even as TikTok's popularity grows.

This DIY approach is even more pronounced among women entrepreneurs. More than 3 in 4 have taken their financial education into their own hands, saying that self-teaching and personal learning has taught them the most about managing personal and/or business finances (78%), despite 7 in 10 reporting some school-based financial education. Yet, the gender gap persists: 80% of male small business owners report receiving financial education during their school years, compared to 71% of women small business owners.

In the face of gender disparities, digital technology may be helping women to bridge the gap. Just like their consumer counterparts, women in business are turning to social media for financial insights and advice. Nearly half (47%) of women entrepreneurs use social platforms for advice on managing finances with YouTube leading the pack (27%), a sign that the information age is empowering women to take control of their financial futures and level the playing field, one click at a time.

Sample and methodology

Consumer Survey

Intuit commissioned an online survey, completed in November 2024, of 2,600 consumers (adults aged 18+) throughout Canada. Three in 10 respondents (31%) work full-time for a business with 100+ employees, while 13% work full-time for a business with 10-99 employees. Less than 5% work full-time for a business with 1-9 employees. The remaining respondents are engaged in freelance or volunteer work, studying as students or interns, or are retired. The survey sample is nearly two-thirds female (65%) and one-third male (35%), with Gen Z (ages 18-27) representing 14% of the participants. To ensure the survey findings are as representative as possible, they have been re-weighted using post-stratification based on local census data. For clarity, percentages have been rounded to the nearest decimal place—so values shown in charts and graphics may not add up to 100%. Responses to multiple choice survey questions are shown as a percentage of the number of respondents, not the total number of responses, so will always sum to more than 100%. Respondents received remuneration.

Small Business Survey

Intuit commissioned an online survey, completed in November 2024, of 478 small business owners and decision-makers (adults aged 18+) throughout Canada. Nearly 40% of respondents own businesses with no employees, while 35% own businesses with 1-9 employees. Of the remaining respondents, 20% hold decision-making positions: 10% at businesses with 10-99 employees, and 10% at businesses with 1-9 employees. Over half of survey respondents (55%) identified as female. For clarity, percentages have been rounded to the nearest decimal place—so values shown in charts and graphics may not add up to 100%. Responses to multiple choice survey questions are shown as a percentage of the number of respondents, not the total number of responses, so will always sum to more than 100%. Respondents received remuneration.

Disclaimer

This content, report and materials are for informational purposes only and should not be considered legal, accounting, financial, investment, or tax advice, or a substitute for obtaining such advice specific to your business. Additional information and exceptions may apply. Applicable laws may vary by state or locality. No assurance is given that the information is comprehensive in its coverage or that it is suitable in dealing with a customer’s particular situation. Intuit Inc., or its affiliates do not have any responsibility for updating or revising any information presented herein. Accordingly, the information provided should not be relied upon as a substitute for independent research. Intuit Inc., or its affiliates do not warrant that the material contained herein will continue to be accurate nor that it is completely free of errors when published. Readers should verify statements before relying on them.

We provide third-party links as a convenience and for informational purposes only. Intuit Inc. or its affiliates do not endorse or approve these products and services, or the opinions of these corporations or organizations or individuals. Neither Intuit Inc. nor its affiliates assume responsibility for the accuracy, legality, or content on these sites.