Do you know exactly where every dollar you earn goes each month? If you don’t, zero-based budgeting might be worth a try. This popular budgeting method asks you to allocate every dollar you earn to specific expenses, giving each of those dollars a specific job.

Unlike traditional budgets that might leave room for overspending, zero-based budgeting aims for precision. Think of it as a financial puzzle where every piece matters. You assign your income to various categories until you reach zero.

Zero-based budgeting’s clear view into spending habits and financial goals makes it a go-to method for many. Read on to find out if it’s a fit for managing your finances.

What is zero-based budgeting?

Zero-based budgeting allocates every dollar of your income to specific expenses, savings, or debt payments. The goal is to give every dollar a purpose, leaving zero income unassigned at the end of each month.

This approach differs from many other budgeting styles in that it effectively requires you to justify every expense. And because you start with a clean slate each time instead of following the previous month’s budget, it forces you to regularly reassess and readjust your spending based on your changing needs and priorities.

Unlike traditional budgets that might leave wiggle room, zero-based budgeting demands precision. It encourages you to think critically about each dollar and its purpose and works well if you want a high level of control over your finances.

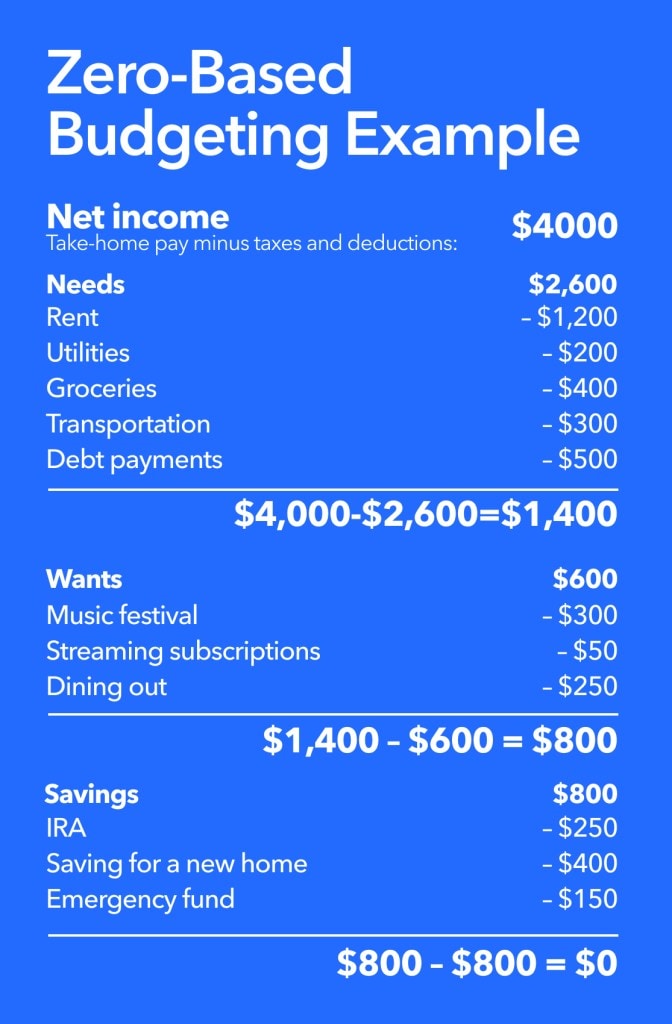

Zero-based budgeting example

Here’s what a zero-based budget might look like:

Monthly take-home pay: $4,000

Expenses:

- Rent: $1,200

- Utilities: $200

- Groceries: $400

- Transportation: $300

- Debt payment: $500

- Savings: $800

- Entertainment: $300

- Miscellaneous: $300

- Total: $4,000 (Remaining income: $0)

After covering essentials, extra money typically goes toward financial goals like boosting savings, paying off debt faster, or investing.

Budgeting apps can help you track expenses, adjust categories, and do all the math. They make it easier to maintain zero out your budget and stay on top of your financial goals.

Pros and cons of zero-based budgeting

Is zero-based budgeting the perfect solution for everyone? Not necessarily. Let’s explore its pros and cons.

Pros

- Enables clear control of money: You know exactly where each dollar goes.

- Encourages spending with intention: It helps you think carefully about where you spend money.

- Helps you set goals: It helps you prioritize and achieve your financial goals.

- Promotes honest spending: It helps you see where you might be saving too little or spending too much.

Cons

- Requires time commitment: Zero-based budgeting needs regular updates and tracking.

- Lack of flexibility: Every dollar is assigned a purpose, so it can be hard to handle unexpected expenses.

- Difficult with fluctuating income: Zero-based budgeting can be tough for those with changing earnings.

- Staying consistent and accountable: Sticking to the plan can feel restrictive.

Zero-based budgeting shines brightest in its ability to keep you accountable. However, it demands more effort than other methods. You’ll need to regularly review and adjust your budget, which can be a lot of work.

The method works best for those with stable incomes. If your earnings fluctuate, you might have to set a conservative baseline budget and allocate extra earnings as they come in. And unexpected expenses can throw off your carefully planned budget, requiring on-the-fly adjustments.

Despite these challenges, many find that the increased awareness and control outweigh the extra effort.

Creating your zero-based budget

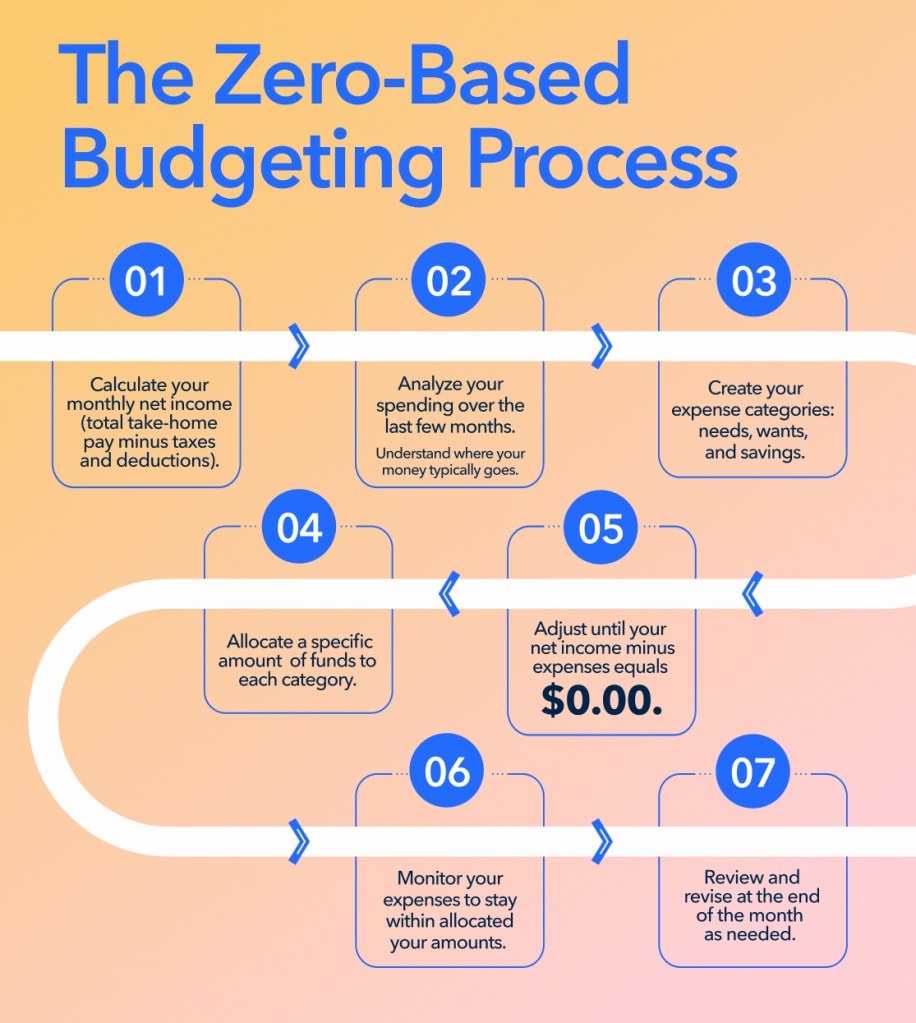

While it takes some time and planning, creating a zero-based budget is a straightforward step-by-step process. Here’s how to create your budget template:

- Calculate your monthly income. Start by determining your total take-home pay for the month. Include all sources of income.

- Review past expenses. Analyze your spending over the last few months. This gives you a realistic picture of where your money typically goes.

- Create your expense categories. Account for every type of expense, including:

- Fixed costs (rent, utilities)

- Variable expenses (groceries, entertainment)

- Savings and investments

- Debt payments

- Emergency fund contributions

- Allocate funds to your expense categories. Assign a specific amount to each. Start with essential living expenses, then move to financial goals and discretionary spending.

- Adjust until you reach zero. Keep tweaking the amounts in each category until you’ve assigned every dollar and your income and expenses zero out.

- Track your spending. Monitor your expenses throughout the month to stay within your allocated amounts.

- Review and revise regularly. At the end of each month, assess your budget and adjust it based on your actual spending and changes in your financial situation.

Update your zero-based budget to maximize its effectiveness. For example, it’s imperative to adjust it regularly for upcoming expenses or changes in income.

And keep your financial goals at the forefront. As you pay off debts or reach savings milestones, redirect those funds to other priorities. This could mean padding your emergency fund or boosting your travel budget.

Enhancing your zero-based budget

Zero-based budgeting can be highly motivational. Seeing your progress toward eliminating debt or reaching savings goals can inspire you to stick with your budget for the long haul.

Remember, effective budgeting is just one element of your overall financial health. A strong foundation in financial literacy pays off. Browse Intuit’s extensive resources and build your skills in saving, investing, retirement planning, responsible credit usage, and more.

The more you understand about personal finance, the better equipped you’ll be to make informed decisions about your money. This content is part of our comprehensive guide on budgeting. For more insights on various budgeting methods and financial management strategies, check out our complete budgeting guide. Discover the tools and knowledge you need to take control of your finances and achieve your financial goals.