A budget is a summary of how much money you bring in and how much you spend. Think of it as a financial roadmap to measure and guide your income and expenditures for a certain period, such as a month, quarter, or year.

Budgeting may seem daunting, but it’s simpler than you might think. It’s about gaining clarity on your income and expenses. With a clear understanding of what a budget is and how to create one, you can track your spending and saving habits. And that’s the first step toward reaching your financial goals.

Why do you need a budget?

A budget is more than just a spreadsheet of numbers. Its many benefits can boost your financial health in countless ways. Here’s how:

- It helps you control your spending. A budget helps keep your spending in check by offering a clear view of how your income stacks up against your expenses.

- It helps you achieve your long-term goals. If, for example, you hope to retire by 50, budgeting can tell you exactly how much to save monthly

- It can make you feel more financially secure. There’s nothing worse than feeling overwhelmed by your finances. Having a budget puts you in control. That way, you’ll be prepared for unexpected expenses and feel more confident and secure in your financial health.

- It can help you get out of debt. Debt can be scary, but budgeting is your way out. Budgeting can help you save part of your paycheck to pay off your debts, like credit cards, medical bills, college loans, or unpaid taxes.

- It keeps you organized. Having a budget helps you manage and organize your monthly bills, debt payments, and other expenses.

- It helps you save money. Instead of living paycheck to paycheck, budgeting can keep you ahead of the curve to save money for the present and future.

Types of budgets

So, where do you start? Beginning your budgeting journey doesn’t have to be overwhelming. These tried-and-true budgeting methods can get you started on the right foot.

Zero-based budgeting

Zero-based budgeting assigns every dollar of income to a specific expense or saving goal, leaving zero money unaccounted for. This gives you a concrete plan for every dollar you earn.

The envelope system

This cash-based budgeting method allocates money to different spending categories using physical envelopes. You label envelopes for things like bills, vacations, or credit cards and fill them with a set amount of money each pay period.

Pay yourself first (the 80/20 budget)

This strategy prioritizes saving by putting 20% of your income directly into savings before budgeting the remaining 80% for expenses. This simple approach is great for beginner budgeters.

Value-based budget

This method aligns your spending with your personal values and priorities. The idea is to allocate money toward what matters most to you, whether that’s saving for a vacation, donating to charity, or indulging in hobbies (e.g., toys or cars). But remember to always prioritize essential financial obligations over discretionary spending.

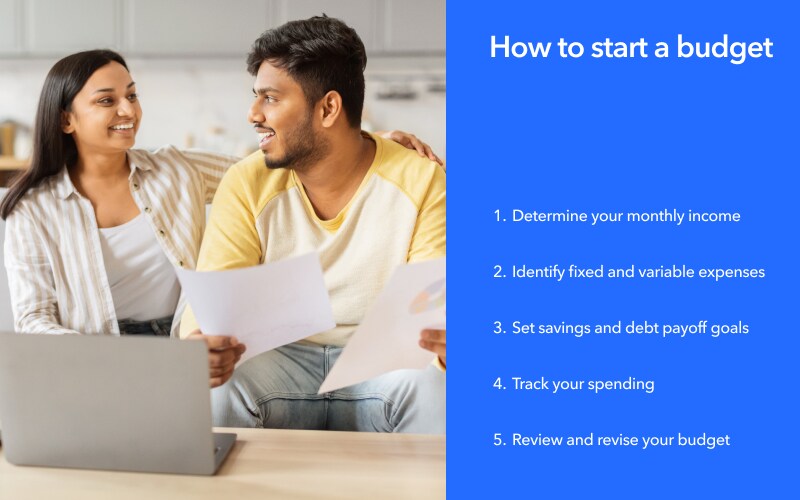

How to start a budget

Taking the time to understand what a budget is and how to create a sound one can put your financial goals within reach. The process does take some elbow grease (and minor math).

If you’re reading this and need to get your finances back on track, know you can do it. Budgeting starts with these five steps.

1. Determine your monthly income

An accurate picture of your monthly income is the cornerstone of a successful budget. Without accounting for what’s in your wallet, it’s hard to allocate funds toward saving, spending, and paying down debt. To calculate how much you’re earning, you’ll need to do some simple math.

You’ll need two figures: your gross income and net income.

Gross income is how much you earn before any deductions. For example, if you make $60,000 a year or $40 an hour, that’s your gross income.

Your net income—often called take-home pay—is what’s left after taxes and other withholdings. To calculate this number, take your gross income and subtract federal and state taxes and withholdings such as retirement contributions or health insurance premiums.

2. Identify fixed and variable expenses

When building your budget, you’ll encounter two main types of expenses: fixed and variable. Fixed expenses stay the same each month, while variable expenses … vary.

Fixed expenses

Common fixed expenses include:

- Rent

- Mortgage

- Car payments

- Student loans

Once you’ve built a complete list of fixed expenses, calculate a monthly estimate for each so you know how much of your income to dedicate to them.

Variable expenses

Examples of variable expenses include:

- Entertainment

- Groceries

- Dining out

- Gas

- Clothing

- Dating

- Ride-sharing

- Utilities

Determining how much you spend on variable living expenses each month is tricky since they’re inherently inconsistent. But an accurate estimate is important for assessing whether your spending habits are sustainable or if you need to make adjustments.

3. Set savings and debt payoff goals

Determine how much money you want to save each month and how much you need to allocate toward debt repayment. For example, you might want to put money toward saving for large purchases like a new car or an expensive vacation. Or you may need to pay down debts like student loans or credit card balances.

Our debt repayment calculator can help you plan your strategy and make your goals less intimidating. After all, they say the best way to eat an elephant is one bite at a time.

4. Track your spending

Record all your expenses to ensure you’re sticking to your budget. There are several ways to do this, including spreadsheets, online budgeting tools, and even good old pen and paper. Budgeting apps can simplify this process by linking directly to your bank account and breaking your spending down by category.

5. Continually review your budget and revise when necessary

Your budget shouldn’t remain stagnant. Things change, after all. You might get a raise or make significant progress paying off debt. And then there are life events like marriages or births that require an overhaul of your budget. Consider it a best practice to regularly assess your budget and adjust as your financial goals change.

Common budgeting mistakes

Like most things in life, budgeting isn’t always clear-cut. Ambiguity and variability are simply part of the process. Factoring in random, one-time expenses or calculating earnings from a part-time gig can complicate your budget, but it’s no reason to throw in the towel.

Let’s review some common budgeting missteps and tips to overcome them to help you stick to your budgeting habits.

1. Estimating irregular income

If you’re a freelancer or have a side hustle, your income is likely variable and hard to predict. In these cases, it’s best to estimate a conservative (low) amount so you don’t overspend.

Review the past 3 to 6 months of income and estimate an approximate hourly or weekly rate for what you bring in. Above all, do your best to pin down an estimate, knowing you can tweak it as you go.

2. Paying for emergency expenses

Emergencies happen. Car troubles. Job loss. Medical expenses. The list goes on. Budgeting an emergency fund can help you financially prepare for these sorts of situations.

Consider allocating a portion of your income toward an emergency fund each month. Adjust your spending in other areas to help make it happen. For instance, you might cut back on dining out for the month or pick up an extra shift to help you build your emergency savings.

3. Forgetting one-time expenses

It’s easy to forget expenses like annual memberships, vacations, and gifts for family and friends when creating budgets. If you can, set aside a small monthly cash for them.

Estimate these expected costs for the year and account for them in your monthly budget. For example, if you typically spend $300 on Christmas gifts, set aside an extra $25 monthly to account for these added expenditures. By December, you’ll have the cash available to spend on gifts.

Start budgeting today for a better financial future

You’ve learned the basics of budgeting, and with tools like budgeting apps on your side, you have everything you need to take control of your finances. Don’t wait. Get started today—the best time to start budgeting is always now.

Budgeting is just one step toward a brighter financial future. Intuit is here to help you build your financial confidence in all areas. Explore our extensive knowledge hub, which is filled with financial literacy resources on saving, building credit, responsible borrowing, and more.

This content is part of our guide to budgeting. Keep reading to learn everything you need to know about starting, refining, and mastering the budget basics on your way to financial freedom.