There’s no limit to what the smartphone in your pocket can do. Sure, it’s a great source of news and entertainment, but it can be a tool to help you get ahead. And, if your finances are an area you’re looking to improve, there’s no shortage of budgeting apps to help get you on track.

However, the challenge becomes wading through the sea of options and choosing the one that works for you. To help you make your decision, here’s our list of the best budgeting apps available today.

Best budgeting apps

To help you make the best decision for your budgeting needs, this guide will contain detailed profiles of the following apps:

- You Need a Budget (YNAB)

- EveryDollar

- Goodbudget

- PocketGuard

- Monarch Money

- Quicken Simplifi

YNAB

App summary

YNAB (You Need a Budget) positions itself as an all-in-one money tool. Users can sync their bank accounts to the app, share their financial profiles with friends and family, split transactions (i.e., spend from multiple categories in a single transaction), and even calculate loan payments. YNAB also enables users to track their net worth and pull reports as their finances grow.

Type of budget it’s best for

The app’s philosophy is that you give every dollar of your income a job, making it a perfect fit for a zero-based budget.

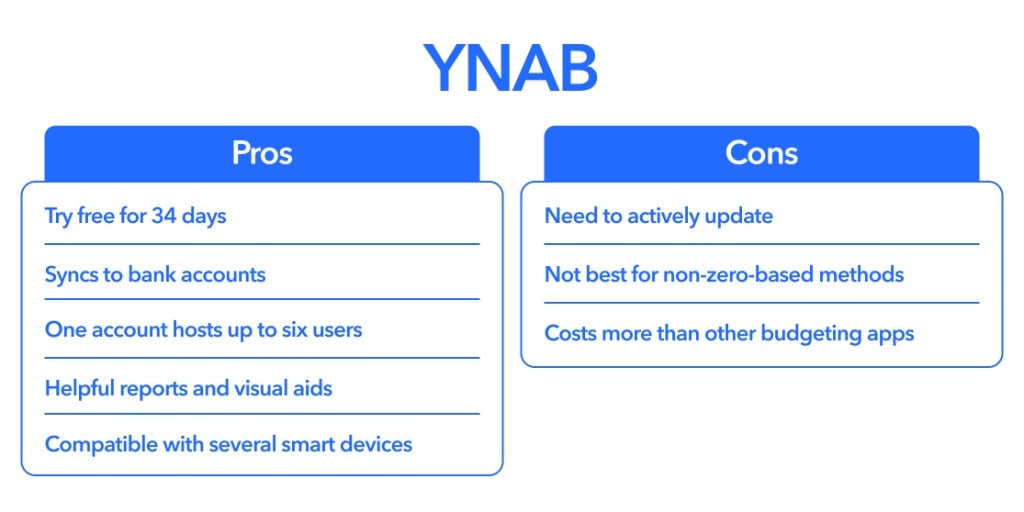

Pros and cons

- Pros

- You can try YNAB free for 34 days.

- It syncs with your bank accounts and automatically imports transactions.

- One account can host up to six people.

- It produces reports and visual aids to help you easily understand your finances.

- YNAB is available for smartphones, tablets, Apple watches, and Amazon Alexa.

- Cons

- You’ll need to be active with the maintenance and upkeep of your YNAB profile.

- It’s not the best fit for methods other than zero-based budgeting.

- YNAB costs more than most of the other best budgeting apps on our list.

Cost

YNAB offers new users a free trial for 34 days. After that, you can pay an annual fee of $109 ($9.08 per month) or $14.99 per month.

Google Play and Apple App Store ratings

YNAB has a 4.8-star rating across 50,000-plus reviews in the Apple App Store and a 4.7-star rating across more than 19,000 reviews in Google Play.

EveryDollar

App summary

EveryDollar is a budgeting app from personal finance guru Dave Ramsey. The app allows you to create a budget, split transactions between items, manage your budget on multiple devices, and track savings goals.

Type of budget it’s best for

EveryDollar supports the zero-based budgeting method. Every dollar (hence the name) of your monthly income is accounted for. You can make unlimited categories and line items to support your spending habits.

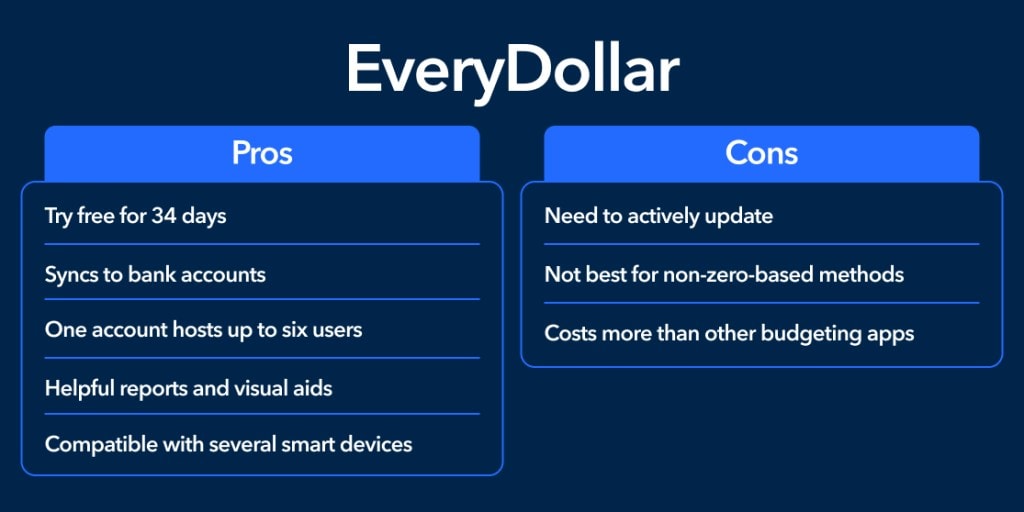

Pros and cons

- Pros

- The platform aligns with Dave Ramsey’s popular personal finance model.

- It gives you access to custom budgeting reports and financial coaching.

- It simplifies zero-based budgeting.

- Cons

- There are very few features.

- The free version requires you to enter information manually.

- The premium version is costly.

Cost

A free EveryDollar account is available, but its features are limited. You can unlock the platform’s premium features with either of two payment models: $79.99 annually or $12.99 monthly. Both options offer a free 14-day trial.

Google Play and Apple App Store ratings

EveryDollar has a 4.7-star rating in the Apple App Store across more than 66,000 reviews. In Google Play, the app has a 3.8-star rating and more than 11,000 reviews.

Goodbudget

App summary

Goodbudget is essentially a digital version of the tried-and-true envelope budgeting method. It works like this: Users create digital envelopes for each budget category that’s important to them. These can include things like rent, groceries, debt payoff, and vacations. Goodbudget will even flag you for overspending with red envelopes.

Type of budget it’s best for

Since this app revolves around digital envelopes, it’s best for the envelope budgeting system.

Pros and cons

- Pros

- It makes budgeting simple.

- There’s a free version.

- The app provides helpful resources.

- The platform offers spending reports.

- Cons

- The free version offers limited functionality.

- Even the paid version has limited features.

- There are no tools or resources for investing.

Cost

Goodbudget offers a free and paid version of the app. The free version limits your number of envelopes, support, and accounts. The premium version offers unlimited envelopes, accounts, and access to up to 5 devices. This plan costs $10 per month or $80 per year.

Google Play and Apple App Store ratings

Goodbudget currently has a 4.6-star rating in the Apple App Store. That’s based on more than 12,000 reviews. Nearly 20,000 Android users have reviewed the app in Google Play, where it currently has a rating of 3.9 stars.

PocketGuard

App summary

PocketGuard is an all-in-one budgeting app. The platform connects with your financial accounts, helps you track and schedule all your recurring expenses, and even enables you to review your net worth and cash flow growth.

Type of budget it’s best for

PocketGuard offers many personal finance features, but its budgeting approach is best suited to the zero-based budgeting strategy.

Pros and cons

- Pros

- You can manually add or sync accounts and transactions.

- You can build a personal budget and set savings goals.

- In My Pocket helps you quickly view your pocket money.

- Cons

- Only basic features are available for free.

- There’s very little in the way of data analysis.

- It offers no free trials for premium tools.

Cost

A PocketGuard plan billed annually will run you $74.99 (the equivalent of $6.95 per month). The monthly subscription model costs $12.99 per month.

Google Play and Apple App Store ratings

With more than 7,000 ratings in the Apple App Store, PocketGuard holds a 4.6-star rating. In Google Play, PocketGuard has over 2,000 ratings and 3.6 stars.

Monarch Money

App summary

Monarch Money is an AI financial assistant that lets you track your goals, transactions, and investments in one place. The app has many features besides budgeting and enables you to add a user, like your financial advisor or partner.

Type of budget it’s best for

The Monarch website doesn’t explicitly state this, but the app appears to be best for zero-based budgeting. Users can create categories and set a goal amount, which is compared against actual spending on both monthly and annual time frames.

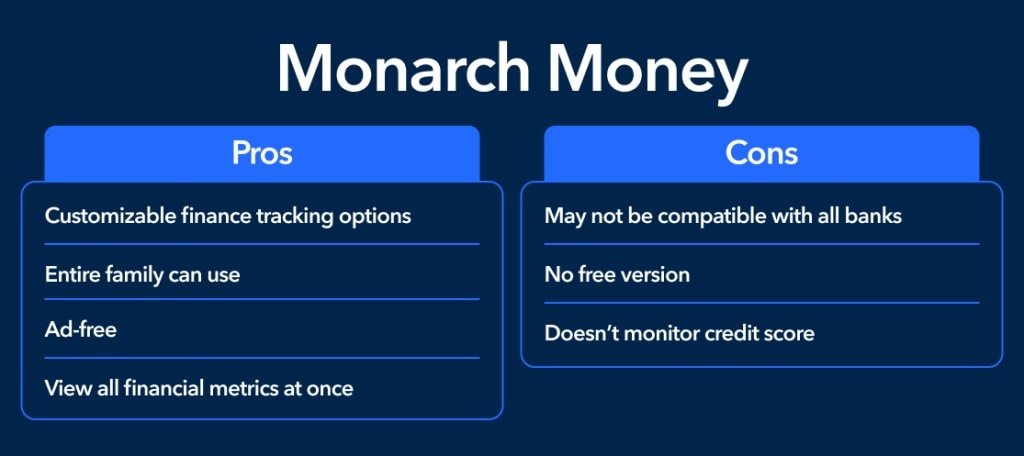

Pros and cons

- Pros

- It offers customizable finance tracking options.

- It’s easy for an entire family to use.

- The platform is ad-free.

- You can view all your financial metrics at once.

- Cons

- You might run into trouble connecting with some financial institutions.

- There’s no free account available.

- It doesn’t monitor your credit score.

Cost

Monarch users will pay $69.99 for an annual plan (or $5.83 per month). A monthly subscription is $14.99.

Google Play and Apple App Store ratings

Monarch Money has a 4.9-star rating across more than 28,000 reviews. In Google Play, the app has just over 6,000 ratings and a score of 4.7 stars.

Quicken Simplifi

App summary

Quicken Simplifi helps you track and categorize your spending and plan for the future with projected cash flows. The app offers automation, real-time alerts, and data insights. And its centralized dashboard helps you track your financial accounts and savings goals all in one place.

Type of budget it’s best for

Simplifi’s versatility accommodates a range of budgeting methods. The app tracks your expenses and then tells you how much money you have left over to spend or save.

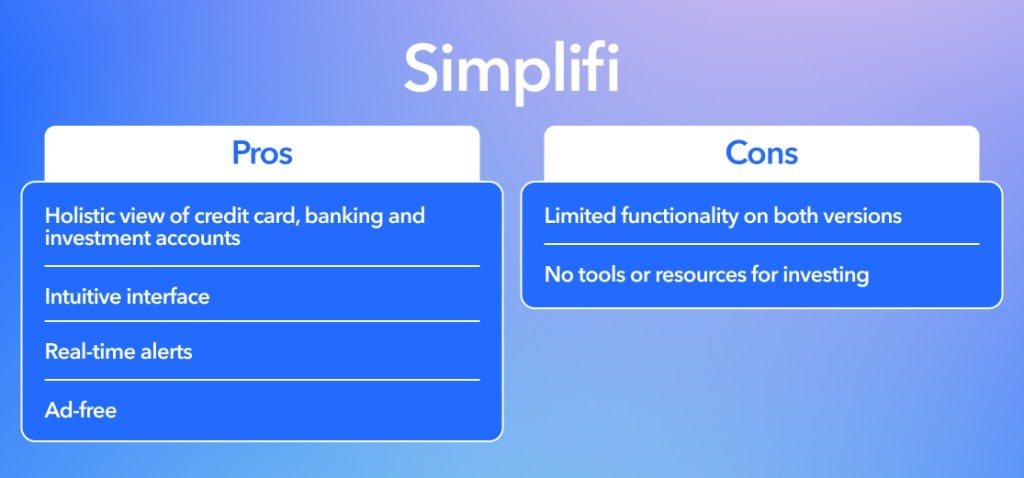

Pros and cons

- Pros

- You can connect credit card, banking, and investing accounts for a holistic view of your finances.

- The app’s interface is intuitive and easy to use.

- The platform’s real-time alerts are helpful in managing your financial goals.

- There are no upsells or ads.

- Cons

- There’s no free account option.

- It has few tax features.

- There are no tools for business reporting.

Cost

Quicken Simplifi plans start at $3.99 per month.

Google Play and Apple App Store ratings

Quicken Simplifi has more than 3,000 reviews in the Apple App Store with a rating of 4.2 stars. In Google Play, the app has over 2,000 reviews and a rating of 4.1 stars.

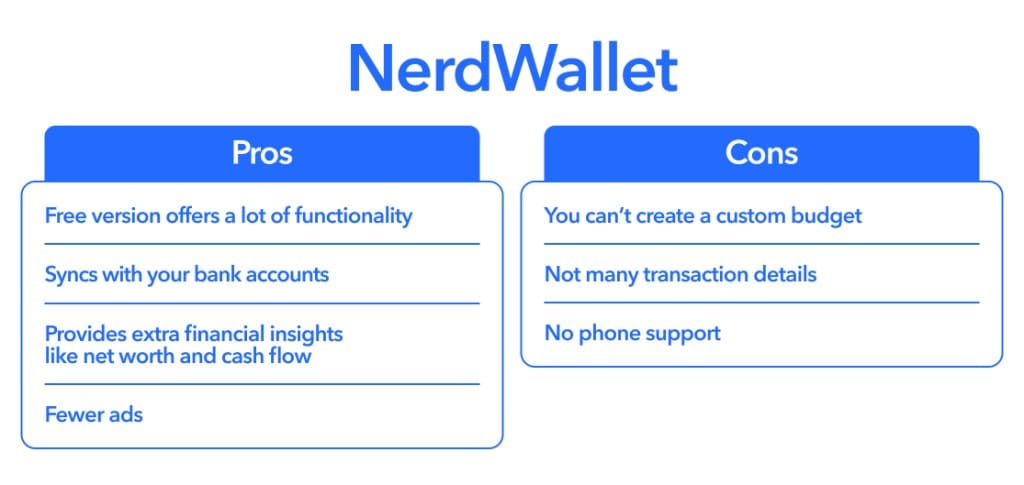

NerdWallet

App Summary

Most apps will allow you to create a budget, track your credit score, or track investments and net worth. NerdWallet’s app enables you to watch everything, across all areas of your finances. You can track your cash flow, net worth, credit score, home value, and more through visual dashboards. This all-in-one approach makes it a perfect fit for many users.

Type of budget it’s best for

NerdWallet’s app allows you to link all your accounts so you can track and funnel your expenses into one of the three categories (needs, wants, or investing). You’ll also see a basic snapshot of money in vs. money out each month, and the app will offer you insights based on spending trends.

Pros and cons

- Pros

- Free version offers a lot of functionality

- Syncs with your bank accounts

- Provides extra financial insights like net worth and cash flow

- Fewer ads

- Cons

- You can’t create a custom budget

- Not many transaction details

- No phone support

Cost

NerdWallet’s free version does have more functionality than some other apps. However, the paid version gets you access to more bells and whistles. NerdWallet’s premium subscription, NerdWallet+, will cost you $49 per year.

Spendee

App summary

Spendee offers income and expense tracking, smart budgets, and cash flow monitoring all within their mobile app. You can connect bank accounts and share wallets with your partner or other family members to help with family budgeting.

Type of budget it’s best for

Spendee doesn’t claim to be best for any specific budget. Instead, the goal of the Spendee app is to simplify expense tracking. Once you use the app to get a handle on your spending patterns, then you can put money towards whatever goal you have, like a new car, a down payment on a house, or a vacation.

Pros and cons

- Pros

- Free version available

- Automatically or manually categorize expenses

- Shared wallets

- Easier to stop overspending with smart budgets

- Cons

- Account syncing is only for premium users

- Some banks won’t sync

- No bill pay or credit monitoring

- Android users may struggle with the app interface

Cost

Spendee has two premium plans. You can upgrade from the free version to Spendee Plus for $14.99 per year or Spendee Premium for $22.99 per year.

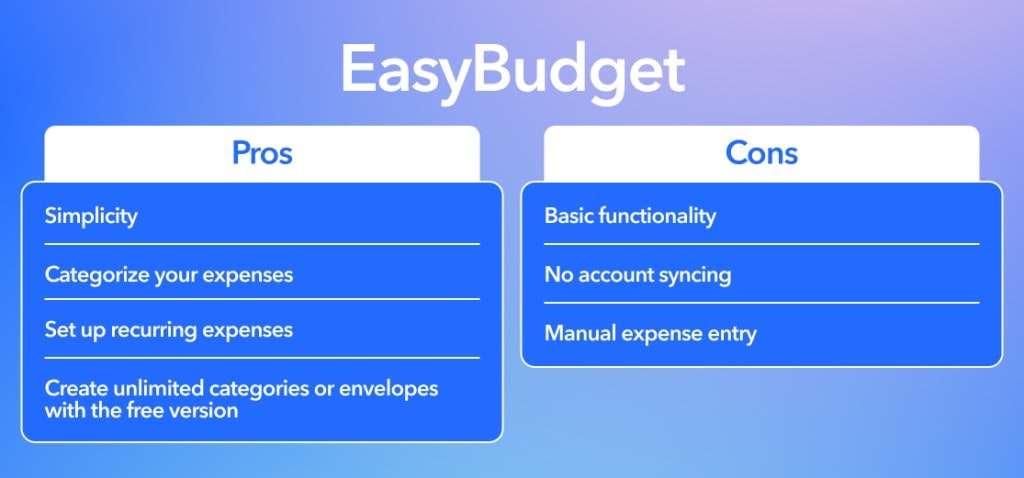

EasyBudget

App summary

EasyBudget is a simple budgeting app that enables you to track your income and expenses. You can share your budget with other users, making the app easy to use for couples and families who want a straightforward solution to personal finance

Type of budget it’s best for

The free version of EasyBudget is essentially a calendar for tracking income and expenses. However, the app does enable you to create categories and mark payees, so EasyBudget could be good options for zero-based budgeting or the envelope system.

Pros and cons

- Pros

- Simplicity

- Categorize your expenses

- Set up recurring expenses like mortgages, utilities, etc. to log automatically

- Create unlimited categories or envelopes with the free version

- Cons

- Basic functionality

- No account syncing

- Manual entry or receipt scanning to enter expenses

Cost

EasyBudget’s professional version is one of the more cost-friendly premium versions available when it comes to budgeting apps. You can access premium features for a one-time payment of $3.87 (or £2.99—the app developer is based in France).

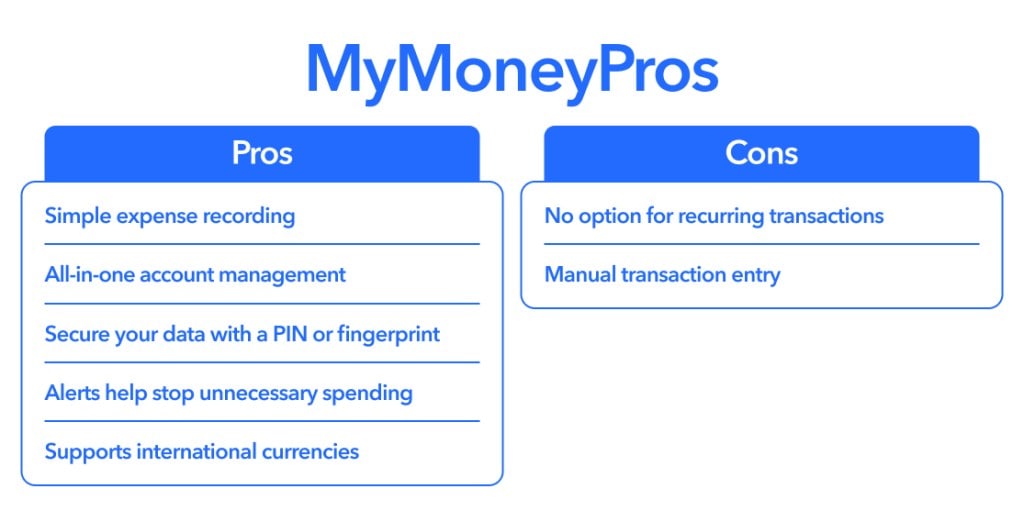

MyMoney

App summary

MyMoney is an easy-to-use personal finance app. The platform provides tools like its budget planner and money manager to help users manage all their accounts on a daily, weekly, or monthly basis. Record income, expenses, debt, and recurring bills and payments in just a few taps.

Type of budget it’s best for

MyMoney is most likely best for zero-based budgeting and similar types of budgets. The app allows you to create spending categories that could easily translate to these two strategies. However, the app doesn’t allow you to set limits for each of those categories, so it’s up to you to monitor the percentages or amounts.

Pros and cons

- Pros

- Simple expense recording

- All-in-one account management

- Secure your data with a PIN number or fingerprint

- Alerts help stop unnecessary spending

- Supports international currencies

- Cons

- No option for recurring transactions

- Manual entry

Cost

MyMoney Pro is its own individual app which you can purchase for a one-time price of $4.99.

How we identified the apps on this list

It’s important to note that we didn’t fill out this list just by pulling names out of a hat. We used a thoughtful methodology in considering the best budgeting apps.

The names on this list are here because they had at least a 3.5-star rating on both apps and more than 2,000 reviews. Additionally, these apps can sync with your financial accounts and provide financial tracking or future planning.

Get the most out of your favorite budgeting apps

These budgeting apps are great for achieving your financial goals. Budgeting apps can help, but maximizing their power requires a solid understanding of personal finance.

That’s where Intuit’s library of financial literacy resources comes in. Learn more about important concepts like taxes, investments, loans, and using credit effectively and responsibly.

This article is part of our comprehensive budgeting guide, where you can learn more about the concepts behind these apps. Topics include how to create a budget, what to include in a budget, and some of the most popular budgeting methods.