When managing your money, living expenses are the heavy hitters. You know, those recurring costs that keep a roof over your head, food on your table, and the lights on. They’re the financial equivalent of VIPs—very important payments.

Having a clear handle on these essential costs is crucial. It’s not just about knowing what they are but understanding how to manage them effectively within your overall budget. After all, these expenses form the foundation of your financial life.

In this chapter of our budgeting guide, we dive deep into living expenses. We’ll explore what counts as a living expense, how to categorize them, and, most importantly, how to budget for them.

By the end, you’ll have practical strategies to tackle your living expenses head-on. You’ll be better equipped to ensure these necessary costs don’t overshadow other important financial goals.

Ready to get started? Let’s break down living expenses and build up your budgeting skills.

What are living expenses?

So, what exactly qualifies as a living expense? Simply put, living expenses are the costs you incur for basic daily living and maintaining your health and safety. These are the non-negotiables—the bills you must pay to keep your life running smoothly.

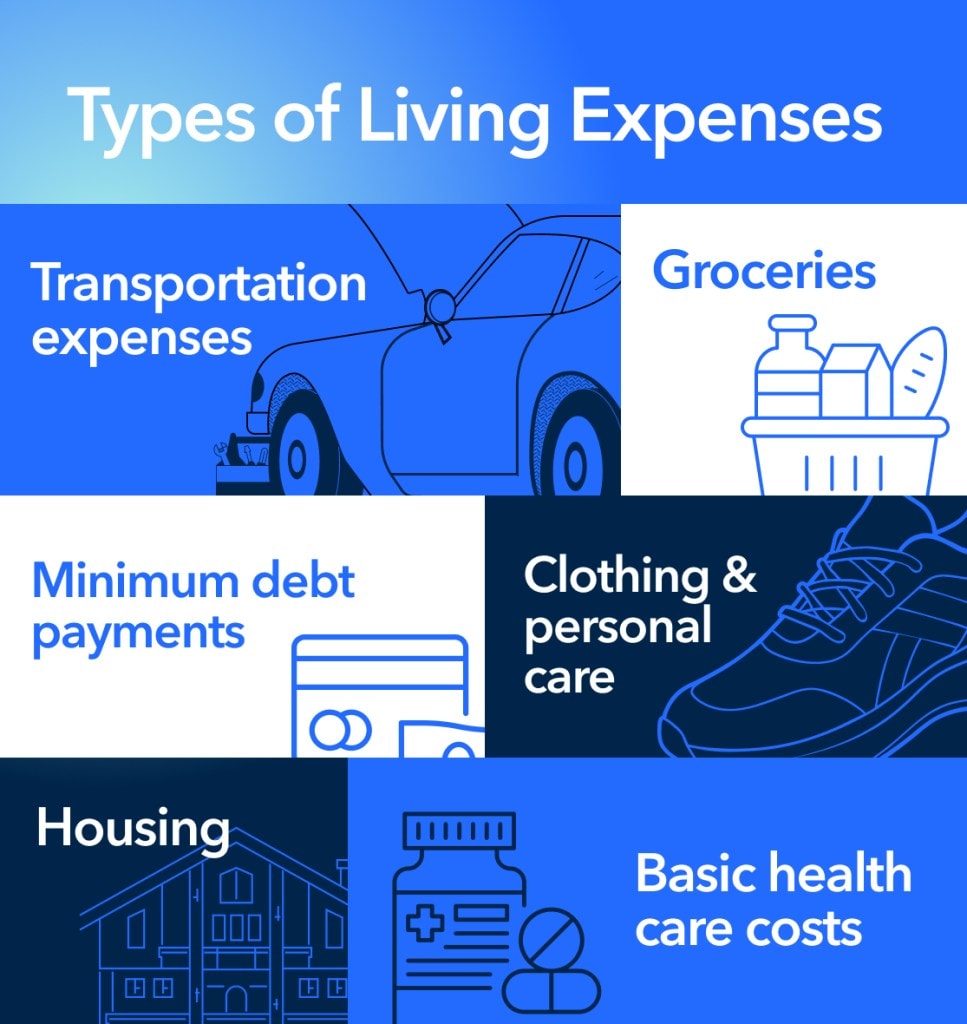

Typically, living expenses include:

- Rent or mortgage payments

- Groceries and essential food items

- Utilities (water, electricity, gas)

- Basic health care costs

- Transportation expenses (car payments, insurance, fuel, or public transit fares)

- Essential clothing

- Minimum debt payments (like student loans or credit card minimums)

Now that we have a clear picture of what typically constitutes a living expense, it’s important to draw a line between these essentials and more discretionary spending.

That daily latte habit? Sorry, that’s not making the cut as a living expense. Neither is your Netflix subscription or your weekend entertainment fund. These are important for your quality of life, sure, but they’re not essential for basic living.

Knowing what qualifies as a living expense is the first step in creating a realistic budget that covers your needs while leaving room for your wants and savings goals.

Categories of living expenses

Now, let’s break down living expenses into categories. This will give you a clearer picture of where your money is going each month. Keep in mind that these costs can vary widely depending on where you live, your lifestyle, and your circumstances.

According to U.S. Bureau of Labor Statistics (BLS) data, the average American household spent about $77,280 on all expenses in 2023. Let’s dive into how that breaks down across different categories of living expenses.

Housing costs

Home sweet home doesn’t always come cheap. Housing often takes the biggest bite out of your budget. This category includes:

- Rent or mortgage payments

- Property taxes

- Homeowners or renters insurance

- Essential home maintenance and repairs

On average, Americans spent about 33% ($25,436) of their total expenses on housing in 2023, according to the BLS. What people spend on housing can vary significantly depending on where they live. For example, a studio apartment in New York City might cost you more than a three-bedroom house in a small Midwestern town.

Housing costs are especially important for younger people to consider in their budgets. According to a Credit Karma survey, 41% of Gen Z and Millennial renters have to sacrifice necessities to pay rent. A structured budget can help younger people avoid these challenges.

Food and groceries

You’ve got to eat, right? This category applies to the costs of keeping yourself (or your household) fed. It includes:

- Grocery store purchases

- Basic household supplies (like cleaning products and paper goods)

Per the BLS, the average American household spent about $9,985 on food eaten at home in 2023. That’s nearly 13% of their total expenses.

Pro tip: Meal planning or buying in bulk from stores like Sam’s Club or Costco can help decrease these costs.

Transportation

Unless you live in a highly walkable area, you probably need to budget for transportation. This category includes:

- Car payments

- Auto insurance

- Fuel

- Maintenance and repairs

- Public transportation fares

- Rideshare costs

Americans spent an average of $13,174 on transportation in 2023. That calculates to 17% of their total expenses. If you’re a two-car household or live in an area with high gas prices, you might spend more in this category.

Health care

Staying healthy isn’t just good for your body—it’s good for your wallet, too. But even with insurance, health care costs can add up. This category includes:

- Health insurance premiums

- Deductibles and copays

- Prescription medications

- Essential medical supplies

The average American household spent $6,159 (8% of total expenses) on health care in 2023. However, this number can vary widely by individual depending on health status and level of insurance coverage.

Clothing/personal care

While you don’t need a closet full of designer duds, you do need to budget for basic clothing and personal care items. This category includes:

- Essential clothing and footwear

- Personal hygiene products

- Haircuts and basic grooming needs

Americans spend an average of $2,041 annually on apparel and services—nearly 3% of their total expenses. Remember, “essential” is the key word here—impulse-buy personal items don’t count.

Debt payments

For many of us, minimum debt payments are unavoidable in our living expenses. These might include:

- Student loan payments

- Minimum credit card payments

- Personal loan payments

The amount spent on debt payments can vary widely, but it’s not uncommon for people to spend 10% to 20% of their income on debt repayment. If you carry high-interest debt, making more than the minimum payment can save you money in the long run.

How to budget for monthly living expenses

Budgeting for living expenses is like creating a game plan for your money—it helps you cover all your bases without overspending.

How to determine your monthly budget

The first step in budgeting for living expenses is figuring out exactly how much you spend. Here’s a simple process:

- Track your spending: For a month or two, keep track of every penny you spend. You can use a budgeting app, spreadsheet, or good old-fashioned pen and paper.

- Categorize your expenses: Sort your spending into the categories we covered earlier.

- Calculate your monthly income: Determine how much money you bring in each month after taxes.

- Compare income to expenses: Are you spending more than you’re earning? Less? Just breaking even? You need to know how your current income and expenses relate to each other to make changes.

- Set realistic goals: Based on your current spending and income, set some goals for each category of living expenses.

Remember, your first budget probably won’t be perfect, and that’s OK. The key is to start somewhere and adjust as you go.

Budgeting tools

Thankfully, you don’t have to go it alone regarding budgeting. There are tons of tools out there to help make the process easier. Here are a few options:

- Spreadsheets: Excel or Google Sheets can be great for creating a custom budget.

- Budgeting apps: Apps like YNAB (You Need A Budget) or Every Dollar can help you track expenses and stick to your budget.

- Envelope system: This old-school method involves putting cash for each expense category in separate envelopes.

- Budgeting calculator: Tools like Credit Karma’s Budget Calculator can help you determine how much you should spend in each category based on your income.

The best tool is any tool you’ll use consistently, so try out a few and see what works best.

Budgeting methods

There’s no one-size-fits-all approach to budgeting. Here are a few popular methods you might want to try:

- Zero-based budgeting: In this method, you assign every dollar to a job, so your income minus expenses equals zero.

- Pay yourself first: With this approach, you set aside savings as soon as you get paid, then budget the rest for expenses.

- 60% solution: This method advises limiting committed expenses to 60% of your gross income, with the rest split between retirement savings, long-term savings, short-term savings, and fun money.

Remember, the best budgeting method is the one that works for you and that you can stick to consistently.

Budgeting tips

Now that we’ve covered the basics, here are some tips to help you stretch your budget and make the most of your money:

- Track your spending: Knowledge is power. Knowing where your money is going is the first step to controlling it.

- Look for areas to cut: Can you reduce your utility bills by being more energy-efficient? Could you save on groceries by meal planning or using coupons?

- Negotiate your bills: While it’s not always guaranteed, many service providers, like cable, internet, and sometimes even utilities, are open to negotiation.

- Consider a “no-spend” challenge: Try going a week or a month without spending on nonessentials. You might be surprised at how much you save.

- Increase your income: Consider a side hustle or ask for a raise at work to boost your income.

- Use cash for discretionary spending: It’s easier to overspend with a card. Try using cash for things like entertainment and dining out.

- Automate your savings: Set up automatic transfers to your savings account so you’re not tempted to spend that money.

- Review and adjust regularly: Your budget shouldn’t be set in stone. Review it regularly and make adjustments as needed.

- Plan for irregular expenses: Don’t forget about those once-a-year costs like car registration or holiday gifts.

- Give yourself some wiggle room: Build a little flexibility into your budget. Life happens, and you don’t want to feel defeated if you go a few dollars over in a category.

Any of these budgeting methods might work for you. The important thing is to stay consistent with the method you choose, keep trying, and adjust until you find what works for you.

Manage your living expenses for a brighter financial future

Congratulations! You’ve taken a big step toward financial wellness by learning how to budget for your living expenses.

Remember, the goal isn’t to live a life of deprivation. It’s about making intentional choices with your money to cover your needs, work toward your goals, and still have room for the things that bring you joy.

As you continue your financial journey, remember that financial literacy is key. The more you understand about managing your money, the better equipped you’ll be to make smart financial decisions.

Keep tracking, keep adjusting, and keep moving forward. Your future self will thank you for the effort you’re putting in today.

This content is part of a more complete guide to personal budgeting. For more insights on creating and sticking to a budget, check out our comprehensive budgeting guide. Whether you’re just starting out or looking to refine your financial strategy, our guide has something for everyone.